It has been promised for 25 years. Its coming has been heralded as a world-changing event. It has launched a thousand headlines in the last few months. And it happened this week. But if you blinked you would have missed it.

What am I talking about? Why, the launch of a Chinese yuan-denominated oil futures contracts on the Shanghai International Energy Exchange, of course! Or, in more headline-appropriate terms: The Birth of the Petroyuan!

Considering this event has been in the works for literally a quarter of a century (since the Chinese tried and failed to launch such a contract in 1993), the occasion came and went with remarkably little fanfare, even from the ChiCom mouthpiece press. Take Xinhua’s decidedly low-key announcement: “China launches crude oil futures trading.” No celebration of the glorious arrival of the dawn of a new monetary order. No bold proclamations about the impending dominance of the Chinese benchmark in global oil sales. Not even a screed about how the fearless leader, President For Life Xi, is bravely steering the country toward a petroyuan utopia. Just:

China on Monday launched trading of the yuan-denominated crude oil futures contracts at the Shanghai International Energy Exchange, which is the first futures listed on China’s mainland to overseas investors.

The listed futures for trading are contracts to be delivered from September this year to March 2019. The benchmark prices of 15 contracts were set at 416 yuan (65.8 U.S. dollars), 388 yuan and 375 yuan per barrel, varied by delivery dates.

Li Qiang, Shanghai’s Party chief, and Liu Shiyu, chairman of China Securities Regulatory Commission, together rang the gong to open the trading session.

Oh, and the name of this earth-shaking, world-changing futures contract? “SC1809.” It’s like they’re going out of their way to make this whole story as unremarkable as possible.

But still, here it is. The event that everyone’s been waiting for. A first, tentative step toward the petroyuan and one potential way for the international community to step away from the petrodollar. So what does it mean?

Find out what this new yuan-denominated oil futures contract means for the future of the global monetary system (and what it doesn’t mean) in this week’s Corbett Report Subscriber newsletter.

For full access to the subscriber newsletter, and to support this website, please become a member.

For free access to this editorial, please CLICK HERE.

|

The Corbett Report Subscriber

|

vol 8 issue 12 (March 31, 2018)

|

by James Corbett It has been promised for 25 years. Its coming has been heralded as a world-changing event. It has launched a thousand headlines in the last few months. And it happened this week. But if you blinked you would have missed it. What am I talking about? Why, the launch of a Chinese yuan-denominated oil futures contracts on the Shanghai International Energy Exchange, of course! Or, in more headline-appropriate terms: The Birth of the Petroyuan! Considering this event has been in the works for literally a quarter of a century (since the Chinese tried and failed to launch such a contract in 1993), the occasion came and went with remarkably little fanfare, even from the ChiCom mouthpiece press. Take Xinhua’s decidedly low-key announcement: “China launches crude oil futures trading.” No celebration of the glorious arrival of the dawn of a new monetary order. No bold proclamations about the impending dominance of the Chinese benchmark in global oil sales. Not even a screed about how the fearless leader, President For Life Xi, is bravely steering the country toward a petroyuan utopia. Just:

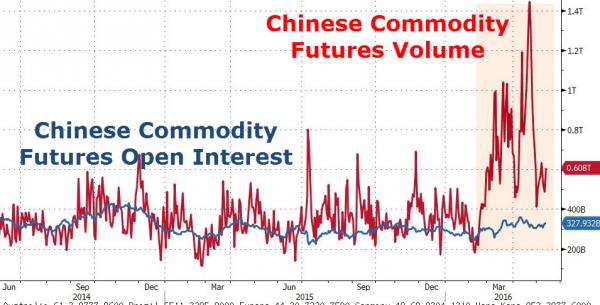

Oh, and the name of this earth-shaking, world-changing futures contract? “SC1809.” It’s like they’re going out of their way to make this whole story as unremarkable as possible. But still, here it is. The event that everyone’s been waiting for. A first, tentative step toward the petroyuan and one potential way for the international community to step away from the petrodollar. So what does it mean? Well, that really depends whether you’re talking short-term or long-term. I’ve discussed the long-term ramifications of this move before, most notably in “China’s New World Order: Gold-backed oil benchmark on the way.” Quick recap: The Shanghai Energy Exchange’s yuan-denominated oil contracts, combined with the Shanghai Gold Exchange’s yuan-denominated gold fix means that it may one day be possible for a country (like, oh, say, Russia) to sell oil to China in yuan and exchange that yuan for gold, thus completely bypassing the dollar. Cue the “end of the dollar paradigm” theme. But hold on just a minute. That certainly is the long-term vision being pursued, and there’s no doubt that China, Russia, Iran and many other countries around the world would jump at the chance to create a viable alternative to the petrodollar…but are we really that close? Short answer: No. No, we aren’t. Longer answer: Remember when China promised to build an alternative to the SWIFT Network that the banks use to transmit transaction data between countries? You know, the network that’s “totally not political” even though the EU strong-armed it into de-listing Iranian banks for political reasons in 2012? And then remember how the truth emerged that China’s so-called SWIFT “alternative” was actually going to be run on the SWIFT Network itself? Do you think there might be some similar shenanigans going on with this petrodollar “alternative?” If so, then might I just say you are an extremely jaded and skeptical person. You are also correct, so give yourself a cookie. Just read the fine print on the SC1809 contracts, as related by Xinhua: “At the beginning, US dollars can be used as deposit and for settlement. In the future, more currencies will be used as deposit.” So (for the moment, at least) this isn’t a golden ticket for bypassing the dollar. Overseas traders will still be putting dollars in and getting dollars out. The yuan will just be the denomination of the contract. Also, the prospect of SC1809 challenging Brent Crude or WTI for the title of “global oil benchmark” is still a long ways off. China’s capital controls and pegging of the yuan mean that it is still useless as a world reserve currency or an international settlement currency. Until Beijing releases its death grip on the yuan, it’s not going to be embraced by China’s foreign trading partners, let alone non-Chinese trading partners elsewhere in the world. Another factor: China’s commodities markets are no stranger to the same speculative frenzy that has led to the highly-risky, highly-leveraged “umbrella trusts” and “Wealth Management Products” and stock-collateralized loans of the Chinese stock bubble and bust. When nickel debuted on the Shanghai exchange in 2015, trading volume surpassed that of the benchmark future on the London Metal Exchange within six weeks. But that volume was part of a general speculative madness. Most Chinese trading steel rebar futures, for example, had no idea what they were trading; they just saw it as another investment opportunity. So it is not difficult to imagine a similar frenzy happening with yuan-denominated oil futures. It’s just another chance for the big returns that Chinese investors have come to expect from the rigged-iest of the world’s rigged markets (to coin a phrase). If such a frenzy does eventuate, though, those investors may want to take note of what happened in China’s commodities futures market in 2016. When things got too hot, the Chinese government stepped in to tighten regulations, restrict trading hours and boost fees. In the oil futures space, too, the government can and will intervene whenever they don’t like the direction of the market. Having said all of that, make no mistake: The long-term trend, should it be allowed to continue, is toward the rise of the petroyuan. Consider:

All of these developments point the way toward a future where China and its trading relationships tip the scale away from the petrodollar and toward the petroyuan. Assuming Beijing does loosen the reins and allow liberalization of the yuan, it will eventually make more sense for nations to settle their bilateral trade with China in yuan directly rather than going through the dollar. Of course, this all depends on these trends being allowed to continue, which is still an open question. After all, we know what happens to nations that try to step out from under the petrodollar umbrella. At any rate, don’t look for the world to change overnight. But historians of a future era may just be recording March 26, 2018 as the day the change started. |

Recommended Reading and Viewing

Recommended ReadingGuess what NATO calls Russia’s new ICBM? Recommended ListeningRecommended ViewingSpin Just For FunTHE GOASTT (The Ghost of a Saber Tooth Tiger) – Tiny Desk Concert – Live |

[supsystic-price-table id=59]

What it will mean is more war as the US attempts to shore up the quadrillions of dollars floating around.

And this shoring up will mean war on Venezuela as Maduro begins to strike deals with India for the petrolrupee

Just found on my doorstep… A zioniol.com investment packet complete with a bumper sticker, 2 DVDs, and 10 cards to hand out that state, “JESUS LOVES YOU,” on one side and bible quotations on the other including John 3:16, Romans 3:23 Romans 10:9 and John 14:6… The cover of the folder has the Israeli and American flags and Genesis 12:2-3 and Genesis 49:1-28… I’m not kidding… There are convoluted messages from John Brown, Founder, and Victor G Carrillo, CEO, Dustin L Guinn (exec vice chairman)Pictures and a blurb of each of the management team, a map of the Golan Heights that is labled “Zion Drill Site…” Thoughtfully included in the back envelope is a Driect Stock Purchase Plan (DSPP) Enrollment form to fill out in ink… Here’s the press release for the shareholder’s meeting in June…https://www.zionoil.com/updates/press-release-zion-oil-gas-mobilizes-equipment-to-israel-for-well-testing-operations/

Pastor John Hagee, in a letter to Chairman & Founder, John Brown:

“I will continue to pray earnestly for the success and unlimited prosperity of Zion Oil in Israel. A major oil development in Israel would create a geopolitical earthquake. I believe you have been called to the kingdom, ‘For such a time as this.'”

hammy,

That is hilarious.

Reminds me of my Texas inbred cousin’s cousin, Joe Bob Briggs, and what he has to say about “Religious Zionist Oil Marketing” or whatever…

https://www.youtube.com/watch?v=xB4Z5wA0Trw&feature=youtu.be&t=4m11s

(By the way, Joe Bob has visited the comment section here at Corbett Report before.)

Sorry, all I could think of was that those markets are going to make Texas oil and gas hawkers look like angels when they get down with that little market! Now it’s off to bed. That’s a scary article, petrodollar hasn’t been a peacenik if you ask me. JimBob from fluorida who never has an opinion anyone likes hearing.

Holy Cow!

I often follow oil, but this was news to me.

But historians of a future era may just be recording March 26, 2018 as the day the change started. — James Corbett

From Corbett’s Recommended Viewing, I am watching the 12 minute clip The Wrongful Killing of Martin Luther King Jr. by “Unnamed Government Officials”. This is good!

https://www.youtube.com/watch?v=uW2JWxQWAH4

Some great photos and video clips.

At one time, “Reprehensor”, a past moderator for 911blogger during the wild days of 9/11 Truth, had a string of YouTube videos which were the actual footage from the 1999 trial.

It was fascinating to watch.

I can’t find them now.

Extremely important breaking news on this topic:

https://www.reuters.com/article/us-china-oil-yuan-exclusive/exclusive-china-taking-first-steps-to-pay-for-oil-in-yuan-this-year-sources-idUSKBN1H51FA

Looks like things might be progressing even faster than I believed.

EXCERPT from Reuters

Unipec, trading arm of Asia’s largest refiner Sinopec (600028.SS), has already inked a first deal to import Middle East crude priced against the newly-launched Shanghai crude futures contract.

~~~

From

http://micetimes.asia/naftalan-entered-the-fray-in-the-petrodollar-2/

EXCERPT

(about the first day of the futures contract trading)

…Participation in them took more than 400 Chinese and foreign customers. They include companies such as Unipec Asia Company Limited, Glencore Singapore Pte Ltd, North Petroleum International Company Limited and many others. In the first hours concluded more than 200 transactions.

Deliveries will be made from the ports of Oman, Qatar, Yemen, Iraq (Basra) and Eastern China. Ports of loading can be further adjusted to reflect market conditions. Supply of oil will remain in the seven storage facilities located in the coastal regions of the Chinese provinces of Zhejiang, Shandong, Guangdong, Liaoning, and also in the deep-sea port of Shanghai….

~~~

In relation to the oil markets, U.S. import/export of oil products…

…On the current trajectory, net imports could indeed turn into net exports in 2020.

https://oilprice.com/Energy/Crude-Oil/US-Petroleum-Imports-Could-Fall-To-Zero-In-2020.html

Homey those links are pretty fun. Laugh out load! For something a little more weird check out

http://tinyurl.com/Steele-Fulford

I wish James could comment on the ex-pat Ben Fulford and the White Dragons .Is Fulford for real? What end of the pool does someone with his credentials swim in ? This is one to scratch my head over. And the suicide of the Arab bad boy in ,Atlanta?

As for Zion Oil, Tulsa is no stranger to Oil and Gas perspecticies, much like Homeys cousin’s stuff on charlatans of God. However when you think you have seen a lot, something like this comes along. Reminds me of the 1982 pump and dump in western Oklahoma gas deals that sent a dozen or so to minimum security prisons across the state not to mention a hundred people to the poor house. They (Brown) sent not one but two boxes as ‘ hammy ‘described above. Oh Jesus save me!

P.S. along the lines of James letter above , same-old-game, is that why. Blue angle Professor

Roth…Glenco dumped so much into contracts on opening day? Meet the new boss same as the old boss. And finally for those who wonder why I am committing on this site. ” its only the giving that makes you what you are”

poetry by Ian Anderson 1969.

I like the part about the WDS saving us. That was a real nice touch. I don’t doubt the mafia influences at all. I just doubt anyone has a greater interest in saving me than me. JimBob who don’t follow nobody. Including hisself.

Yes, eventually, the US Dollar will be replaced as a reserve currency.

There is a cycle to all in the cosmos, including a “reserve currency”.

There is no one in charge guiding the world along a preset determination.

There are individuals and groups who manipulate the environment for themselves, their friends and families benefit, just like you, only they will lie cheat and steal if you let them.

An international world finance trader, Martin Armstrong, says about a petrodollar, yuandollar…

No, it is total nonsense and you are correct – it is designed to rob people of their life savings. There is no “dollar hegemony” for that assumes that the USA is somehow imposing the dollar upon the entire world by sheer will. History shows that the USA has pursued a policy of lowering the value of the dollar for trade purposes. Even the Plaza Accord in 1985 was a deliberate attempt to lower the dollar and it was at that meeting when the USA argued that Europe needed to create a single currency to compete with the dollar.

There is no competition with the dollar and that is the problem. The Fed wanted to raise interest rates back in 2014 but was lobbied by everyone not to. The Fed has lost control of the local economy because the domestic policy has been suppressed by international policy. The IMF, Europe, and emerging markets all pleaded with the Fed NOT to raise interest rates regardless of the domestic policy objectives.

This is complete sophistry and the arguments of people who really have no clue about how the global economy functions. I have been in meetings in Washington where I have been asked how to PREVENT the dollar from being the reserve currency. The answer is simple. There is no law that the USA can pass to bring about such a result.

It is coming. That will be the Monetary Crisis. But every such crisis has resulted in the dollar rising. That will bring the new monetary system. Not a lower dollar.

https://www.armstrongeconomics.com/uncategorized/dollar-hegemony-real-or-sophistry/

That was a pretty pure shot of sanity you just put up. Almost like the world’s still just spinning round and round. JimBob