So, you’ve watched How BlackRock Conquered the World and you’re now aware of how this financial behemoth with trillions of dollars of assets under management has taken over vast swaths of the economy. You know how BlackRock is one of the top institutional investors in seemingly every major Fortune 500 company, and you understand how Fink and the gang are leveraging this incredible wealth to wield political and social power, directing industry and ultimately steering the course of civilization.

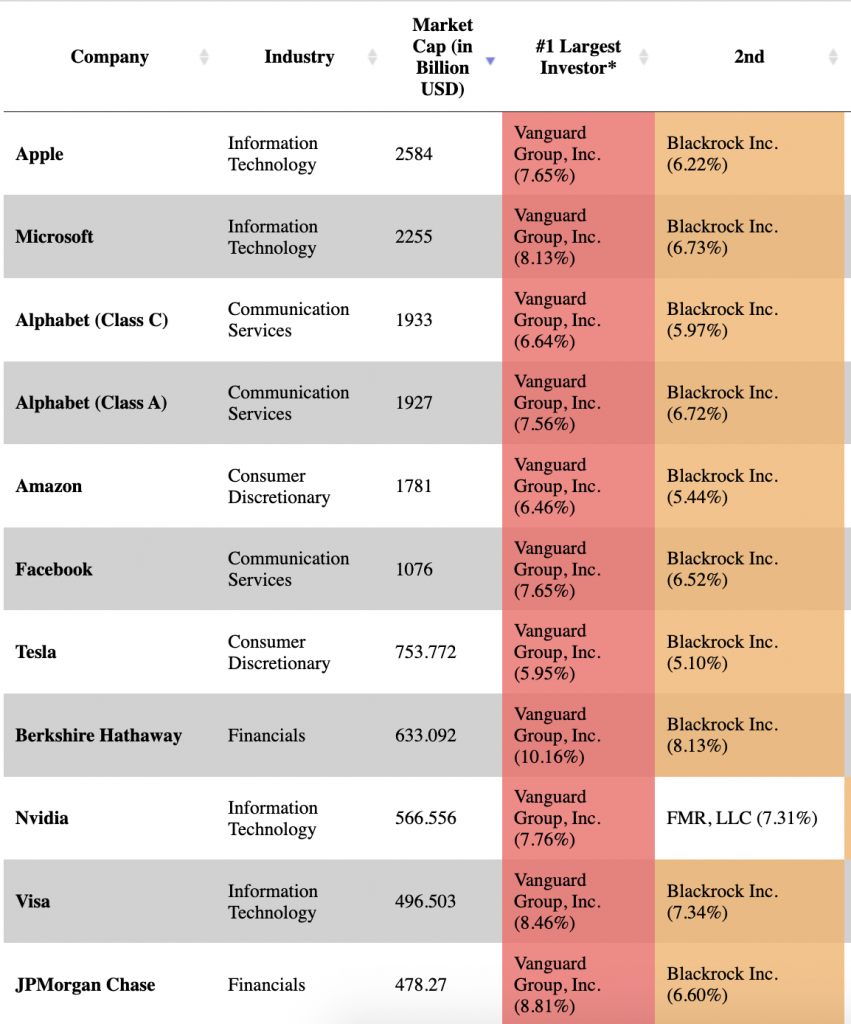

And since you did watch that podcastumentary to the very end, you’ll also remember how I pointed out that the top institutional investor in most of these companies is not BlackRock, but The Vanguard Group.

So what is The Vanguard Group? Where did it come from? What does it do? And how does this financial colossus fit into the overall BlackRock/ESG/Net Zero plan for the future of the (controlled) economy? Good questions! Let’s roll up our sleeves and get to work answering them.

To access this week’s edition of The Corbett Report Subscriber, please sign in and continue reading below.

Not a Corbett Report member yet? Sign up to BECOME A MEMBER of the website and read the full newsletter or CLICK HERE to access the editorial for free.

|

The Corbett Report Subscriber

|

vol 13 issue 27 (September 24, 2023)

|

| by James Corbett corbettreport.com September 24, 2023 The Rise of VanguardJust as the official history of BlackRock starts with the humbling of a rising star of the financial world—with BlackRock founder Larry Fink having supposedly learned a valuable lesson in risk management after he lost $100 million in a single quarter at First Boston investment bank—the Vanguard story, too, begins with the lemons-to-lemonade tale of a financial whiz kid. In the Vanguard case, the story starts with John Clifton “Jack” Bogle, a titan of the financial industry whose conservative investment ethos was forged, we are told, in the crucible of The Great Depression. Born in New Jersey in May 1929—just months before the great stock market crash that wiped out his family’s fortune, drove his father to alcoholism and, ultimately, led to his parents’ divorce—Bogle was forced to buckle down and excel at his schoolwork even as he worked an assortment of jobs to help keep the family afloat. Beating the odds, Bogle ended up getting a scholarship to study economics at Princeton. But, being an average student at a prestigious institution full of bright, ambitious young phenoms, Bogle knew he would have to produce a stellar senior thesis in order to stand out. Vowing to write about something that had never been covered before, he found his thesis topic in the pages of the December 1949 issue of Fortune magazine: the mutual fund industry. Mutual funds, Investopedia informs us, are financial vehicles that “pool assets from shareholders to invest in securities like stocks, bonds, money market instruments, and other assets.” They had existed in the US in various forms since the late 19th century, but it was a series of acts passed by Congress in the wake of the 1929 stock market crash—including, most notably, the Investment Company Act of 1940—that paved the way for the explosive growth of the mutual fund industry in the mid-20th century. Bogle just happened to read the right article at the right time to catch the very first wave of what would eventually become a financial tsunami. If Bogle had hoped to turn his flagging academic career around with his thesis, he succeeded. Not only did the thesis lead to a magna cum laude diploma from Princeton, it even caught the eye of Walter Morgan, founder of the prestigious Wellington Fund, the first balanced mutual fund in the United States. Morgan offered the young whiz kid a job at Wellington Management Company, the firm that managed the fund, and Bogle set out on what would become a storied career. Becoming an assistant manager in 1955, Bogle oversaw a period of explosive growth for the firm and the mutual fund industry as a whole. He persuaded management to capitalize on the public’s growing interest in such investments by creating a new fund composed solely of equities, the Wellington Equities Fund. The new fund’s success and Bogle’s hard work cemented his position as Walter Morgan’s hand-picked successor. He would go on to become president of the company in 1967 and CEO in 1970. It was a decision Bogle made at the height of the go-go ’60s bull market, however, that would prove to be what he later identified as his greatest mistake. In 1966, facing growing competition from a crop of newer, riskier mutual funds that were promising investors greater returns than the boring, conservative Wellington funds, Bogle forged a merger with the investment counseling firm of Thorndike, Doran, Paine and Lewis, managers of the up-and-coming Ivest Fund out of Boston. But Bogle and his new partners quickly found they had different visions for the merged company. So, when the bull market ended in the 1970s and the stock market cratered, the partners banded together to have him fired as chief executive of Wellington Management Company. Bogle would later identify the merger as the greatest mistake of his career and his subsequent firing as the lowest point of that career. But being let go would serve as the springboard for the creation of The Vanguard Group. Bogle came up with a plan to turn the lemon of being fired into the lemonade of a new venture:

The boards of the various Wellington funds went along with this idea and they decided to keep Jack as their president. He then proposed that—in a radical break from industry norms—that the fund boards assume responsibility for their own administrative services, which had been hitherto provided by Wellington Management Company. Wellington Management would stay on as the funds’ investment advisor and principal underwriter, but the fee the funds paid to the management company would be reduced by $1 million to reflect this changeover in administrative services. The okay from the board of the Wellington Group of Investment Companies enabled Bogle to form a new corporation to take over the administration of the eleven funds of the Wellington Group. He named it The Vanguard Group after the flagship of Lord Nelson’s fleet in the legendary Battle of the Nile. “Together, the Wellington tie-in, the proud naval tradition embodied in HMS Vanguard, and the leading-edge implication of the name vanguard were more than I could resist,” he later explained. In one stroke, Bogle had created an entirely new entity that ended up revolutionizing the industry: the “mutual” mutual fund, in which profits did not flow to the management company, but back to the funds themselves, meaning that, “as a practical matter, Vanguard attempted to operate at cost and pass the savings on to the shareholders.” There was yet another hurdle Bogle had to surmount. The funds’ directors decided that Vanguard was to have the narrowest of mandates: it would only look after the funds’ administration and would not be permitted to engage in advisory or investment management activities. Bogle overcame this restriction by proposing a completely passive fund, one that would not be actively managed but instead be tied to the performance of the S&P 500 index. To say that the initial reaction of seasoned investors to this innovation was disparaging would be an understatement. Dubbed “Bogle’s Folly,” the idea of investing not in a single company but in an entire index was alternately derided as a “cop out,” as a “search for mediocrity,” and—given its eschewal of the traditional market ethos of picking winners and dropping losers—as “un-American.” Unfortunately for Bogle, the criticism was not confined to mere name-calling. It also helped deter would-be investors from subscribing to the fund. The $150 million underwriting target for the very first mutual index fund, First Index Investment Fund, proved to be overly ambitious. Indeed, when the initial underwriting was finished in August 1976, however, the fund had collected only $11 million. That wasn’t even enough to invest in all 500 of the S&P 500 stocks, as was the fund’s intention. So the fund managers settled for investing in the top 200 stocks, plus 80 others that had been selected as representative of the remaining 300 stocks. Nevertheless, they pressed ahead, and by the end of the year the fund’s assets had grown by $3 million, to $14 million. “Bogle’s Folly” paid off. Literally. The indexing model grew in popularity during the bull run in the early 1980s, and, to capitalize on the idea’s success, Vanguard launched new funds, including a bond index fund and a total market fund that captured the entire stock market minus the S&P 500. Today, The Vanguard Group is the largest provider of mutual funds in the world and the second-largest provider of exchange-traded funds (ETFs) after BlackRock’s iShares. It boasts over $7 trillion of assets under management, and, as we have already seen, is the single largest institutional investor in just about every company of importance in the United States. Who Owns the Shares?OK, so, there you go. That’s the very condensed nutshell version of how Vanguard rose to prominence. And, as we know, Vanguard is now part of the shadowy financial cabal that owns everything. . . . Or do we know that? This is where the fact checkers will come in to make their nasally point about how the conspiracy theorists are wrong. And, you know what? For once, they may not be entirely incorrect. You see, the fact checkers at AAP and Reuters have tackled the question of Vanguard and BlackRock’s growing financial oligopoly in the way fact checkers do: by taking the most ridiculous framing of the argument they can possibly find and contrasting it with the opinions of their credentialed “experts.” In AAP’s case, “Global corporate monopoly claim dances on edge of reality” takes on the very serious issue of the Vanguard/BlackRock leviathan by refuting a Facebook video featuring someone discussing the problem while performing an interpretive dance. After conceding that the two investment firms are indeed the largest shareholders in a number of important companies, AAP then explains that this is for a good reason: they are “strategically investing their client’s [sic] money in order get a good return.” Oh, OK, then. More to the point, AAP then brings in Rob Nicholls—an associate professor of regulation and governance at the UNSW Business School—to lend gravitas to its main thesis: Vanguard and BlackRock don’t “own” Pepsi and Coke and Amazon and Apple and all the other companies cited by the conspiracy theorists. Instead, their holdings in these companies are largely passive investments—either ETFs, in which shares are purchased in proportion to market capitalizations, or index funds, in which shares are purchased in proportion to the index on which they are traded. Thus the purchase and selling of shares in these companies is largely automatic: when a company’s market cap falls or when its stock gains in relation to the overall index, the associated ETF or index fund would be obligated to offload or purchase shares in order to maintain the fund’s mandate. Thus, to the extent that Vanguard and BlackRock holdings represent passive investment, these holdings do not have any sway over the companies or their actions. The argument here is that Vanguard can’t threaten to sell Apple shares if Apple doesn’t conform to the woke agenda, because Vanguard can’t really sell those shares on a whim. Instead, Vanguard is obligated to hold Apple shares in proportion to Apple’s position in the S&P 500 index (at least when it comes to their S&P 500 index fund). And, where there is no credible carrot to reward “good behaviour” (buying shares when Apple does what Vanguard wants) or stick to punish “bad behaviour” (selling shares when Apple doesn’t do what Vanguard wants), then there is no way for Vanguard to directly influence Apple’s behaviour. Besides, as Lorenzo Casavecchia, a senior lecturer at UTS Business School, told AAP FactCheck, “an investor can only control a company if they have more than half of the votes cast at a general meeting.” But even when you combine the shares of the so-called Big Three investors (BlackRock, Vanguard and State Street), their holdings in these major companies do not even approach a majority. Often, they each hold a single-digit percentage point of overall shares. What’s more, as Reuters points out in its fact check on the topic (citing a BlackRock spokesperson, of course): “BlackRock itself is not a shareholder” in these companies. Instead, “the owners of these securities are our clients, through their investments made on their behalf via the funds managed by Blackrock.” The same goes for Vanguard, which likes to brag in its corporate PR that Vanguard “is owned by its funds, which in turn are owned by their shareholders—including you, if you’re a Vanguard investor.” So, the way Vanguard frames it, when you inevitably end up at the question of “who owns Vanguard?” (or “who owns BlackRock?” for that matter), the answer will be: “The investors do!” So, you see? Vanguard and BlackRock (and let’s not forget State Street) don’t “own” the major corporations. They don’t manage those companies or have any influence over them. And, besides, their shares are held on behalf of their investors, so it’s the investors who are really the biggest holders of Apple and Exxon and Walmart and all the rest. Well, I guess that sums it up, folks. Nothing more to see here, right? Vanguard, BlackRock and the Shadows of PowerOh, wait. Of course there is more to this story. True, Vanguard and BlackRock and State Street don’t “own” these companies in the straightforward sense, but to say that the trillions of dollars of assets under their management doesn’t bring with it the clout needed to sway the direction of corporate America as a whole or even of select companies individually is beyond naive. Indeed, as many serious, credentialed researchers—as opposed to the interpretive dancing TikTokers “refuted” by the fact checkers—have pointed out, there are ways that these investment companies can flex the muscles that come with trillions of dollars in investable capital. As even AAP concedes in its fact check (citing Adam Triggs, research director at ANU’s Asian Bureau of Economic Research), there is evidence that common ownership of competing firms (like Coke and Pepsi) reduces competition, helping to cement the corporatocracy into place. This common sensical and obvious point is backed up by researchers like John Coates at Harvard Law School, whose paper, “The Future of Corporate Governance Part I: The Problem of Twelve,” outlines how “in the near future roughly twelve individuals will have practical power over the majority of U.S. public companies.” It shouldn’t take an economist or a university professor to imagine how such intense concentration of ownership could lead to a raft of problems, from higher prices on consumer products to reduced wages and employment. But while you hold your breath and wait for the fact checkers to tell you why this is a totally wonderful turn of events that won’t have any bad consequences whatsoever, you should take the time to digest Coates’ own summarization of the inherent threat that such an intense concentration of ownership poses for the market and even for the rule of law itself:

Then there’s the question of votes. Of course, shareholders get to vote in corporate elections, including electing directors and voting on shareholder resolutions. So who gets to vote when the shares are actually held by an asset manager on behalf of its clients? Traditionally, it’s Vanguard and BlackRock who actually do the voting. Vanguard calls it “stewardship” and likes to brag on its website how its managers “vote in accordance with the funds’ proxy voting policies.” The funds, of course, tell the finger-pointers to just relax. After all, they don’t coordinate their votes as a bloc, so their small percentage of votes won’t decisively sway anything, anyway. But research published in 2017 found that the Big Three do in fact “utilize coordinated voting strategies and hence follow a centralized corporate governance strategy.” Heck, even Bloomberg can see through the propaganda suggesting that their voting power is small and insignificant:

To find out how these votes actually work, you can search Vanguard’s public record of proxy votes. For what it’s worth, a random search of the most recent Vanguard proxy votes for Exxon shows that Vanguard voted against every single resolution, including the ones pushing the woke green technocratic agenda. But the issue remains: if the managers get to vote (even if it’s “on behalf of” their investor-owned funds) in accordance with ill-defined and ever-changing “principles,” who really gets to wield the power of the shares? This is not a trivial issue. BlackRock, at least, recognizing that its claim to be simply a neutral asset manager rather than a civilization-shaping force is undermined by its ability to wield shareholder votes, has made a big PR campaign about introducing and then expanding a scheme to allow investors to opt for voting their own shares. But when considering the <sarc>incredibly difficult</sarc> question of whether the people running the firms that collectively manage tens of trillions of dollars of assets have any sway whatsoever over the firms they are investing in, there is a simple answer: yes. Yes, they do. As I explained in How BlackRock Conquered the World, even the boffins and eggheads at the prestigious universities have been forced to concede (after years of careful study, no doubt) that Larry Fink doesn’t pen his annual “Letter to CEOs” just for the fun of it. The word of Fink does carry weight in corporate boardrooms.

So here’s the $20 trillion question: how much power does a Larry Fink or a Jack Bogle really wield over the world through their companies? Well, on the most basic level, the latter question is easy to answer. Jack Bogle was forced out of the CEO position at Vanguard in 1996, retired as chairman in 2000, and died in 2019, so he isn’t wielding much influence these days. But here’s the more serious point: Larry Fink at BlackRock and Mortimer “Tim” Buckley (the current chairman of The Vanguard Group) do exert power over the economy and, ultimately, over society. As long as their companies remain the top institutional investors in the majority of the stock market, the only question is: how much havoc will they wreak by imposing their will on the world? You have already seen Larry Fink and his woke ESG agenda-pushing. So, how about Buckley? Well, to his credit, Buckley did pull The Vanguard Group out of the Net Zero Asset Managers initiative, claiming that Vanguard is “not in the game of politics” and that “our research indicates that ESG investing does not have any advantage over broad-based investing.” And while Vanguard does offer so-called “sustainable” funds and ESG index funds, they amount to a miniscule percentage of the group’s offerings, with Buckley saying he wants to “allow investors to express their values and preferences” but the decision whether or not to pursue ESG investment “has to be an individual investor’s choice.” Regardless of how much of this is just corporate blather designed to protect Vanguard from the growing ESG backlash (and subsequent withdrawal of investment funds) that has afflicted BlackRock in recent years, the underlying problem persists. Even if Buckley were an angel descended from heaven to protect us from the green woke mobs, who is to say his successor would be an angel, too? The very fact that people like Fink and Buckley are in a position to sway corporate decisions is itself the problem—not the particular ways they wield (or refrain from wielding) that power. Ironically, this point was not lost on Jack Bogle. You’ll note that Bogle is not a name synonymous with nefarious corporate scheming in the same way that Fink currently is. In fact, in recent decades the now-deceased Bogle has become something of a saint in the investment world. His idea of “mutualizing” the mutual funds by cutting out the management company middlemen and thus greatly reducing fees has put upwards of a trillion dollars back in the pockets of ordinary investors (and thereby kept it out of the pockets of Wall Street managers). And his common sense, down-to-earth investment strategies that eschewed get-rich-quick schemes and fancy quant-driven investment trends gave rise to an entire movement of investors who call themselves “Bogleheads” (yes, really), and continue to organize conferences in his name. So what was Bogle’s take on the astonishing growth of Vanguard and BlackRock in the years before his death?

He’s not wrong there, at least. As always, I will note that the incredible power that the Finks and the Buckleys of the world wield is in fact our power, derived from our money through our investments of our time, our energy, our labour and our productive power in the service of their corporate agenda. Thus, the fundamental solution to the problem of Vanguard and BlackRock will not come from some outside force. It will come when we withdraw our wealth from their system. For those who are interested in the solution to the Vanguards and the BlackRocks of the world, they are directed to my recent #SolutionsWatch episode on the subject, How To Defeat BlackRock. |

Recommended Listening and Viewing

Recommended ReadingHow Not to Launch a Global Anti-Censorship Movement OffG’s Fall Fundraiser – You can help make a difference! Recommended ListeningRecommended ViewingWhy are People so Obedient? – Compliance and Tyranny From a listener: World War Has Already Begun… Just For Fun(?)“Future Headlines” from Sovereign Man, including: AOC Wins Epic Presidential Primary Cage Match Ex-Mayor “Harvey” the Ham Sandwich Indicted on RICO Charges Fed’s New CDBC Hacked Just Six Days After Its Launch |

| SUBSCRIBER DISCOUNTS

CLICK HERE to visit the New World Next Week shop and use the coupon code subscriber25 at checkout to receive a 25% discount on any Corbett Report DVD or USB (or the new Mass Media: A History online course) just for being a Corbett Report member! |

Fantastic article!

Very interesting! But the important question still is: who ownes the funds mainly or who are the main investors? Or better, who are the hidden investors behind Fink?

The idea that Fink is the sole person running blackrock is probably like saying Biden is running America. Neither seem very likely

Get stuff, James. Keep up the great work. I agree with your solutions too.

I am trying my best to stay away from their influences (401K and such) and plan on setting aside my value for my benefit, not theirs.

I do believe it is that simple. They must have a host to feed on. If no one ever bought coke again – coke is gone. That goes for each and every other company out there.

Keep up the great work and invest in yourself and your friends!

“How Vanguard Conquered the World” was an excellent explainer. Step by step, Corbett walked us through the story so that the average person can grasp the concepts.

Brilliantly researched and argued.

It’s great to know the Editor en Chief has a sense of humor. He shares those light hearted gems in the ” Just for Fun ” section.

He was asked about that and he sez ” after I crawl down that sewer and open that shit-pipe to the light I need a little humor to clean up my attitude.”

Makes sense to me James, thanks you know for Christs sake I don’t know how you survive it. Guess a person knows now. Eh?

Oh wow James, they’ve almost become Biblical…

We just now, need to hear how ‘goid’ they all are, at covering up for each other…

Not 100% sure (or am I?) Why they all came into my mind while reading your excellent article….you know, the Catholics, Baptists, Methodists and all the rest….like e.g. JP Morgan, Epstein and all the rest of our “beloved,” self-proclaimed and un-elected “elite”…..(with their “intellectual” spittle flying in all directions…?

We truly live in a sad world…

Maybe we will all be “happy and own nothing” (be dead) in a few days, when this “elite” show us all their next mafiosu-tricks “for the fun of it”…

Anyway, thanks for keeping on and on and on…..and on…

Have a good week…?

I bet most who made a long trip to protest at the capitol were sincere and ready to sacrifice for noble principles: that others less brave might hear them declare independence, yet they were out maneuvered by a pesky few who had lotsa practice, plans, and protection. just sayin mass action seems to, in these techy times be manageable by just a few.

Are economies only the sum of what goods and services are churned out, so that if a significant percentage stopped, the misleaders would fall to their knees?

I suspect the “work-to-earn foldable/spendable” game could stop, but doubt that would keep the highest ups from demanding and continuing to be served by everyone else. If they cant baffle the masses with currency, theres other modalities of coercing people to look left when a big sound is coming from the right, or dumbing most down to a serviceable submissiveness.

Once one breaks the 3 arch laws no killing (except to have food enough), no stealing, & no lying, it must be impossible to sustain any peace of mind without faking it further and further, (albright was clearly on that downward spiral). I doubt those types feel much joy ever, theyre setting the examples of the worst one can do with the blessing of a human life. or they simply arent human?

https://www.newsweek.com/watch-madeleine-albright-saying-iraqi-kids-deaths-worth-it-resurfaces-1691193)

boycotting, may help small. We certainly could do with less consuming in every way that we eat (through 7 gates). But if the battlefield truly is in the brain and of the mind, without finishing that battle, boycotting could just be pissing into the wind.

Ignore these criminal psychopaths….

They’re worth less than what you throw in your toilet 5-7 times a day…even less. .

I don’t care if my payment methods (for the goods I need) are in cash or stones …

Get out of this debt-system – if you can’t, then ask these morons to show it up theirs…

I’m not sure who the Hell they think they are – just know there’ll never be any room for them in my life…human scum is the last I need/want….

This needs to be a vidcast.

You had to mention the Duponts, Windsor, the Rothschilds and other elite bloodline names who are part of the Vanguard shareholders. These are the true rulers of humanity.

Bingo

Reminds of James’s video about Lynn Foerster de Rothschild wanting to do away with the ESG term, perhaps a heavy investor in Vanguard (?). The point of course being, whoever has the control, the fact that the power is limited to very few, poses a risk, regardless who the few are, especially when the influence is denied by , most public institutions.

I am confused now. Which is bigger and more influential, Black Rock or Vanguard?

Do they compete with each other, or are they branches of one entity?

To answer this question, correlation between their voting should be found. As usual, monolithic conspiracy seems unlikely.

Thanks for at least noticing my query.

But seriously, I don’t understand the basic questions. Between Black Rock and Vanguard, Who is bigger? Who is more powerful? Who is more nefarious?

In my opinion, Blackrock is more nefarious (Larry Fink, WEF, and ESG promotion), whereas Vanguard was one of the first to distance itself from ESG. Larry certainly is outspoken on his idealisms.

In my opinion, there is also a problem with the “herd mentality” of Wall Street. Stock prices go up when the herd pushes that way, and vice versa.

The herd is comprised of the big players on Wall Street because they control the bulk of money flows, and they control the financial narrative of the day. The money flows is what controls the prices for stocks, bonds and commodities.

The regular retail JoBlo investor is not part of the herd. JoBlo is food fodder. In a manner of broadly speaking, on every stock trade someone loses while another one gains.

It often becomes quite noticable that big players will deceptively push up prices, then sell to the retailer at high prices, and then push the stock price back down. Rinse and repeat.

Personally I think its probably one of those 2 wings of the same eagle situations… left vs right, east vs west, firefox vs chrome, facebook vs twitter, coke vs pepsie, walmart vs every other chain. The elites are always hiding their monopolies and making it appear as the plebs have choices when in reality they seem to control each side.

I don’t have any evidence for this, just a hunch.

Yeah, it seems like they support sides to influence and control. But I think that they are not a monolithic group and compete with each other. They may cooperate sometimes if it benefits them, or if they have no choice. But psychopaths by their nature are out for themselves. They have no real loyalty except to themselves and their own vision and lusts.

Plebs are the cogs in the machine that make it function for now and I think do have a choice, IMO.

If you look at the bylaws of many of the top companies, you will find that in order to nominate someone to the board of directors, you must be a shareholder holding, say 3% of the stock.

In other words, even though the stock is ostensibly owned by the public, only the largest shareholders (i.e. Blackrock and Vanguard), can actually nominate to the board. Obviously if you choose all the nominees, you will always win!

Another top company to look at is Capital Group. Not a lot of information to be found about them, but they also appear as a top holder of stock in these companies.

I’ve come to realize, it’s the merry-go-round of board members, that carry much weight for the direction of the company. The CEO, after all, is subservient to these; who often are unknown to even the employees of their company (as I am personally guilty of). By picking the directors of universities, media outlets, and corporations, one can steer a society by proxy. Again, the hidden hand.

A few thoughts:

The Bond market is larger than the Stock Market, and when combined with Commodity Trading, there are massive sums of money being exchanged daily.

In my opinion, for the most part Wall Street is a “trading game”.

One does not realize a monetary gain or loss until one sells it. This applies to Wall Street or to an individual who trades his own services.

Blackrock, Vanguard and State Street combined with major corporations wield tremendous influence and control.

Nobody can argue with that.

However, the average person probably does not recognize what a massive monster this machine is, nor how this system has designs to enslave us.

It becomes extremely important to wake up the average person to this juggernaut.

IMAGE – JUGGERNAUT https://web.archive.org/web/20111026155407/http://photos3.meetupstatic.com/photos/member/e/1/f/2/highres_4317842.jpeg

(That is a real mining machine.)

A Juggernaut, in current English usage, is a literal or metaphorical force regarded as merciless, destructive, and unstoppable.

The History of Juggernaut

In the early 14th century, Franciscan missionary Friar Odoric brought to Europe the story of an enormous carriage that carried an image of the Hindu god Vishnu (whose title was Jagannath, literally, “lord of the world”) through the streets of India in religious processions. Odoric reported that some worshippers deliberately allowed themselves to be crushed beneath the vehicle’s wheels as a sacrifice to Vishnu. That story was likely an exaggeration or misinterpretation of actual events, but it spread throughout Europe. The tale caught the imagination of English listeners, and they began using juggernaut to refer to any massive vehicle (such as a steam locomotive) and to any other enormous entity with powerful crushing capabilities.

Interesting

https://www.thestreet.com/cryptocurrency/bitcoin/blackrock-etf-is-a-98-billion-vote-of-confidence-for-bitcoin

Is it JP Morgan or is it actually BlackRock, Vanguard and state street that already owns like 90% of the BTC that is already minted??

I sit in the Lord Nelson hotel as I read this. The picture of him has him in full naval regalia. What stands out is his hand firmly in his shirt. The classic “hidden hand” of the Freemason/Illuminati. Naturally, a quick search confirms that Lord Nelson was in fact a Freemason. Of course, the hidden hand jester seems very apropos for Vanguard.

Maybe I should have pursued an education in Finance instead of Sociology; I find the subject fascinating. But I never liked numbers and computers nearly as much as words and people. Lucky for me, here is James Corbett bridging the gap between high finance institutions and sociological control mechanisms. And even with all this relevant and important information, it is the last paragraphs that resonate the loudest:

“our power, derived from our money through our investments of our time, our energy, our labour and our productive power in the service of their corporate agenda. Thus, the fundamental solution to the problem of Vanguard and BlackRock will not come from some outside force. It will come when we withdraw our wealth from their system.”

#Exit and Build

The Recommended Viewing, “Why are People so Obedient” by Academy of Ideas was absolutely brilliant. Will be sharing widely. Thank you, James.

I especially appreciated the mention of the Velvet Revolution in Czechoslovakia, one of the only peaceful overthrow’s in history.

Do not comply. Come to your own conclusions.

Excellent article James.

While you have already in essence expressed the same thing I am about to say (through your many in depth Solutions Watch episodes that focus on cultivating food and medicine at home) I would like to expand on something you said in the article above in order to bring the message home for those new Corbeteers that have not explored your archives yet and are just tuning in now.

Above, you said “..the fundamental solution to the problem of Vanguard and BlackRock will not come from some outside force. It will come when we withdraw our wealth from their system.”

I agree whole heartedly, and I would like to expand on that by saying:

It will come when we withdraw our wealth from their system ??? ??????? ?????? ?? ?? ??? ?????? ????? ??? ?? ??? ????? ???????????.

Thanks for all you do shining light into the shadows and helping the seeds of truth and courage to sprout in hearts and minds all over this beautiful world.