As those who have been following the How BlackRock Conquered the World series know by now, BlackRock, Inc. started out as an asset management subsidiary of investment giant The Blackstone Group, but quickly spun off into its own entity. It made its mark by emphasizing risk management for its clients, and by the time the Global Financial Crisis hit in 2008, BlackRock was perfectly positioned to take over Wall Street, helping to sort through the mess of toxic subprime mortgages that BlackRock CEO Larry Fink had helped pioneer decades before.

And, as we saw last week, BlackRock leveraged this power to begin shaping the course of events. The firm proposed a radical new form of market intervention that central banks could use to pump money directly into the retail economy, and just weeks later the Federal Reserve was employing that very “Going Direct” plan in its repo market intervention. The scamdemic, as it turns out, was largely an excuse for the Fed to cover its multi-trillion-dollar market intervention and for BlackRock to consolidate its mammoth economic and political power by engineering yet another bailout for the benefit of its own investments.

At this point in our exploration, we find ourselves confronting the most important question of all: now that BlackRock has scaled the summit of Mount Olympus and is in control of a mind-boggling amount of wealth, what are Larry Fink and his gang planning to do with their newfound powers? As we shall see, this is not a trivial question. In fact, BlackRock’s ambition is nothing less than to shape the course of civilization for the benefit of itself and its Wall Street cronies.

In Part 1 of this series, A Brief History of Blackrock, I described how BlackRock came to be the economic and political juggernaut it is today.

In Part 2 of this series, I examined how BlackRock’s Going Direct reset paved the way for the massive economic and monetary transition that we have just lived through under the cover of the scamdemic.

This week, we will examine the Aladdin system and the other creepy ways BlackRock is planning to use its power to mould society in its own interest.

To access this week’s edition of The Corbett Report Subscriber, please sign in and continue reading below.

Not a Corbett Report member yet? Sign up to BECOME A MEMBER of the website and read the full newsletter or CLICK HERE to access the editorial for free.

|

The Corbett Report Subscriber

|

vol 12 issue 33 (November 27, 2022)

|

by James Corbett corbettreport.com November 27, 2022 *NOTE: This is Part 3 of the How BlackRock Conquered the World series.Click here for Part 1: A Brief History of BlackRock.Click here for Part 2: Going Direct.PART 3: Aladdin’s Genie and the Future of the WorldAs we saw in Part 1 of this series, BlackRock started out life as “Blackstone Financial Management” in the offices of The Blackstone Group in 1988. By 1992, it was already so successful that founder Larry Fink and Blackstone CEO Stephen Schwarzman spun the company off as its own entity, christening it BlackRock in a deliberate attempt to sow confusion. But it was in 1993 (or so the story goes) that arguably the most important of BlackRock’s market-controlling tools was forged. It was that year that Jody Kochansky, a fixed-income portfolio manager hired the year before, began to tire of his daily 6:30 AM task of comparing his entire portfolio to yesterday’s numbers. The task, done by hand from paper printouts, was long and arduous. Kochansky had a better idea: “We said, let’s take this data, and rather than print it out, let’s sort it into a database, and have the computer compare the report today versus the report yesterday, across every position.” It may seem obvious to us today, but in 1993 the idea of automating a task like this was a radical one. Nonetheless, it paid off. After seeing the utility of having an automated, daily, computer-generated report calculating the risk on every asset in a portfolio, Kochansky and his team hunkered down for a 72-hour code-writing exercise that resulted in Aladdin (short for “asset, liability, debt and derivative investment network”), a proprietary investment analysis technology touted as “the operating system for BlackRock.” Sold as a “central processing system for investment management,” the software is now the core of BlackRock Solutions, a BlackRock subsidiary that licenses Aladdin to corporate clients and institutional investors. Aladdin combines portfolio management and trading, compliance, operations and risk oversight in a single platform and is now used by over 200 institutions, including fund manager rivals Vanguard and State Street; half of the top ten insurers in the world; Big Tech giants like Microsoft, Apple and Alphabet; and numerous pension funds, including the world’s largest, the $1.5 trillion Japanese Government Pension Insurance Fund. The numbers themselves tell the story of Aladdin. It is used by 13,000 BlackRock employees and thousands of BlackRock customers. It occupies three datacentres in the US, with BlackRock planning to open two more in Europe. It runs thousands of Monte Carlo simulations—computational algorithms that model the probability of various outcomes in chaotic systems—every day on each one of the tens of millions of securities under its purview. And, by February 2017, Aladdin was managing risk for $20 trillion worth of assets. That’s when BlackRock stopped reporting this figure, since—as the company told The Financial Times—”total assets do not reflect how clients use the system.” An anonymous source in the company had a different take: “[T]he figure is no longer disclosed because of the negative attention the enormous sums attracted.” In this case, the phrase “enormous sums” almost fails to do justice to the truly mind-boggling wealth under the watchful eye of this computer system. As The Financial Times went on to report, the combination of the scores of new clients using Aladdin in recent years and the growth in the stock and bond markets in that time has meant that the total value of assets under the system’s management is much larger than the $20 trillion reported in 2017: “Today, $21.6tn sits on the platform from just a third of its 240 clients, according to public documents verified with the companies and first-hand accounts.” For context, that figure—representing the assets of just one-third of BlackRock’s clientele—itself accounts for 10% of the value of all the stocks and bonds in the world. But if the idea of this amount of the world’s assets being under the management of a single company’s proprietary computer software concerns you, BlackRock has a message for you: Relax! The official line is that Aladdin only calculates risk, it doesn’t tell asset managers what to buy or sell. Thus, even if there were a stray line of code or a wonky algorithm somewhere deep inside Aladdin’s programming getting its investment analysis catastrophically wrong, the final decision on any given investment would still come down to human judgment. . . . Needless to say, that’s a lie. In 2017, BlackRock unveiled a project to replace underperforming human stockpickers with computer algorithms. Dubbed “Monarch,” the scheme saw billions of dollars of assets snatched from human control and given to an obscure arm of the BlackRock empire called Systematic Active Equities (SAE). BlackRock acquired SAE in the same 2009 deal that saw it snag iShares from Barclays Global Investor (BGI). As we saw last week, the BGI deal was unbelievably lucrative for BlackRock, with iShares being purchased for $13.5 billion in 2009 and rising to a $1.9 trillion valuation in 2020. Testifying to BlackRock’s commitment to the machine-over-man Monarch project, Mark Wiseman, global head of active equities at BlackRock, told The Financial Times in 2018, “I firmly believe that, if we look back in five to 10 years from now, the thing that we most benefited from in the BGI acquisition is actually SAE.” Even The New York Times was reporting at the time of the launch of the Monarch operation that Larry Fink had “cast his lot with the machines” and that BlackRock had “laid out an ambitious plan to consolidate a large number of actively managed mutual funds with peers that rely more on algorithms and models to pick stocks.” “The democratization of information has made it much harder for active management,” Fink told The NY Times. “We have to change the ecosystem — that means relying more on big data, artificial intelligence, factors and models within quant and traditional investment strategies.” Lest there be any doubt about BlackRock’s commitment to this anti-human agenda, the company doubled down in 2018 with the creation of AI Labs, which is “composed of researchers, data scientists, and engineers” and works to “develop methods to solve their hardest technical problems and advance the fields of finance and AI.” The actual models that SAE uses to pick stocks is hidden behind walls of corporate secrecy, but we do know some details. We know, for instance, that SAE collects over 1,000 market signals on each stock under evaluation, including everything from the obvious statistics you would expect in any quantitative analysis of the equities markets—trading price, volume, price-earnings ratio, etc.—to the more exotic forms of data harvesting that are possible when complex learning algorithms are connected to the mind-boggling amounts of data now available on seemingly everyone and everything. A Harvard MBA student catalogued some of these novel approaches to stock valuation undertaken by the SAE algorithms in a 2018 post on the subject.

So, let’s recap. We know that BlackRock now manages well in excess of $21 trillion of assets with its Aladdin software, making a significant portion of the world’s wealth dependent on the calculations of an opaque, proprietary BlackRock “operating system.” And we know that Fink has “cast his lot in with the machines” and is increasingly devoted to finding ways to leverage so-called artificial intelligence, learning algorithms, and other state-of-the-art technologies to further remove humans from the investment loop. But here’s the real question: what is BlackRock actually doing with its all-seeing eye of Aladdin and its SEA robo-stockpickers and its AI Labs? Where are Fink and the gang actually trying to take us with the latest and greatest in cutting-edge fintech wizardry? Luckily, we don’t exactly need to scry the tea leaves to find our answer to that question. Larry Fink has been kind enough to write it down for us in black and white. You see, every year since 2012, Fink has taken it upon himself as de facto ruler of the world’s wealth to pen an annual “letter to CEOs” laying out the next steps in his scheme for world domination. . . . Errr, I mean, he writes the letter “as a fiduciary for our clients who entrust us to manage their assets – to highlight the themes that I believe are vital to driving durable long-term returns and to helping them reach their goals.” Sometimes referred to as a “call to action” to corporate leaders, these letters from the man stewarding over a significant chunk of the world’s investable assets actually do change corporate behaviour. That this is so should be self-evident to anyone with two brain cells to rub together, which is precisely why it took a team of researchers months of painstaking study to publish a peer-reviewed paper concluding this blindingly obvious fact: “portfolio firms are responsive to BlackRock’s public engagement efforts.” So, what is Larry Fink’s latest hobby horse, you ask? Why, the ESG scam, of course! That’s right, Fink used his 2022 letter to harangue his captive audience of corporate chieftains about “The Power of Capitalism,” by which he means the power of capitalism to more perfectly control human behaviour in the name of “sustainability.” Specifically:

Oooh, oooh, I want to lead, Larry! Pick me, pick me! . . . but please, tell me how I can lead my company into this Brave New Net Zero World Order.

Yes, to the surprise of absolutely no one, Larry Fink has signed BlackRock on to the multi-trillion-dollar scam that is “environmental, social, and governance practices and policies,” better known as ESG. For those who don’t know about ESG yet, they might want to get up to speed on the topic with my presentation earlier this year on “ESG and the Big Oil Conspiracy.” Or they can read the summary of the ESG scam by Iain Davis in his article on the globalization of the commons (aka the financialization of nature through so-called “natural asset corporations”):

In other words, ESG is a set of phoney-baloney metrics that are being cooked up by globalist think tanks and would-be ruling councils (like the World Economic Forum) to serve as a type of social credit system for corporations. If corporations fail to toe the line when it comes to globalist policies of the moment—whether that’s committing to industry-destroying net zero (or even Absolute Zero) commitments or de-banking thought criminals or anything else that may be on the globalist checklist—their ESG rating will take a hit. “So what?” you may ask. “What does an ESG rating have to do with the price of tea in China, and why would any CEO care?” The “so what” here is that—as Fink signals in his latest letter—BlackRock will be putting ESG reporting and compliance in its basket of considerations when choosing which stocks and bonds to invest in and which ones to pass over. And Fink is not alone. There are now 291 signatories to the Net Zero Asset Managers Initiative, an “international group of asset managers committed to supporting the goal of net zero greenhouse gas emissions by 2050 or sooner.” They include BlackRock, Vanguard, State Street and a slew of other companies collectively managing $66 trillion of assets. In plain English, BlackRock and its fellow globalist investment firms are leveraging their power as asset managers to begin shaping the corporate world in their image and bending corporations to their will. And, in case you were wondering, yes, this is tied into the AI agenda as well. In 2020, BlackRock announced the launch of a new module to its automated Aladdin system: Aladdin Climate.

To get a sense of what a world directed by digital overlords at the behest of this ESG agenda might look like, we simply need turn to the ongoing conflict in Ukraine. As Fink wrote in his letter to shareholders earlier this year:

The future of the world according to BlackRock is now coming fully into view. It is a world in which unaccountable computer learning algorithms automatically direct investments of the world’s largest institutions into the coffers of those who play ball with the demands of Fink and his fellow travellers. It is a world in which transactions will be increasingly digital, with every transaction being data mined for the financial benefit of the algorithmic overlords at BlackRock. And it is a world in which corporations that refuse to go along with the agenda will be ESG de-ranked into oblivion and individuals who present resistance will have their CBDC wallets shut off. The transition of BlackRock from a mere investment firm into a financial, political and technological colossus that has the power to direct the course of human civilization is almost complete. CONCLUSIONAs bleak as the exploration of this world-conquering juggernaut is, there is a ray of hope on the horizon: the public is at least finally becoming aware of the existence of BlackRock and its relative importance on the global financial stage. This is reflected in an increasing number of protests targeting BlackRock and its activities. For example: NOW – BlackRock HQ in NYC stormed with pitchforks Keen-eyed observers may note, however, that these protests are not against the BlackRock agenda I have laid out in this series. On the contrary. They are for that agenda. These protesters’ main gripe seems to be that Fink and BlackRock are engaged in greenwashing and that the mega-corporation is actually more interested in its bottom line than in saving Mother Earth. Well, duh. Even BlackRock’s former Chief Investment Officer for Sustainable Investing wrote, after leaving the firm, an extensive, four-part whistleblowing exposé documenting how the “sustainable investing” push being touted by Fink is a scam from top to bottom. My only gripe with this limited hangout critique of BlackRock is that it implies that Fink and his cohorts are merely interested in accumulating dollars. They’re not. They’re interested in turning their financial wealth into real-world power. Power they will wield in service of their own agenda and will cloak with a phoney green mantle because they believe—and not without reason—that that’s what the public wants. Slightly closer to the point, you get nonprofit groups like Consumers’ Research “slamming” BlackRock for impoverishing the real economy for the benefit of itself and its clients. “You’d think a company that has made it their mission to enforce ESG (environmental, social and governance) standards on American businesses would apply those same standards to foreign investments, but BlackRock isn’t pushing its woke agenda on China or Russia,” Consumers’ Research Executive Director Will Hild explained earlier this year after the launch of an ad campaign targeting the investment giant. But that critique, too, seems to miss the underlying point. Is Hild trying to say that if only Fink applied his economy-destroying standards equally across the board then he would be beyond reproach? More hopefully, there are signs that the political class—always willing to jump out in front of a parade and pretend they’re leading it—are picking up on the growing public discontent with BlackRock and are beginning to cut ties with the firm. In recent months, multiple US state governments have announced their intention to divest state funds from BlackRock, with 19 states’ attorneys general even signing a letter to Larry Fink in August calling him out on his agenda of social control:

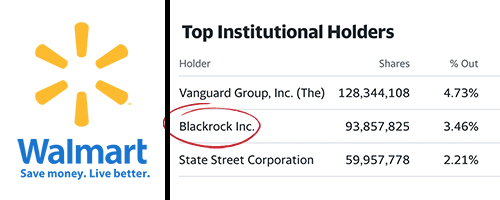

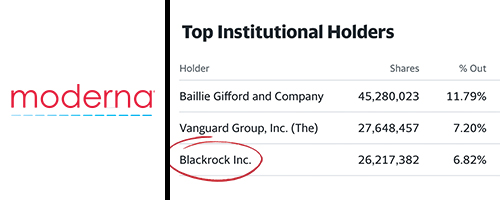

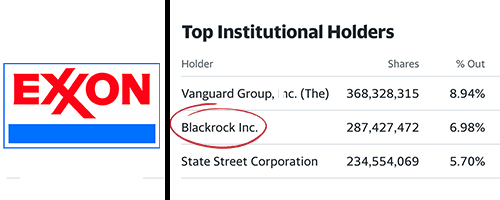

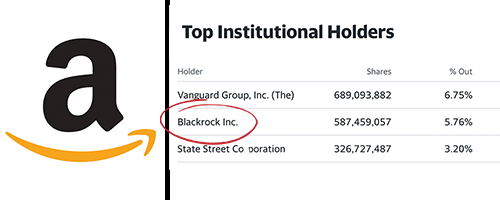

As part of this divestment push, the Louisiana state treasurer announced in October that the state was withdrawing $794 million in state funds from BlackRock, South Carolina’s state treasurer announced plans to divest $200 million from the company’s control by the end of the year, and Arkansas has already taken $125 million out of money market accounts under BlackRock’s management. As I noted in my recent appearance on The Hrvoje Morić Show, regardless of the real motivations of these state governments, the fact that they feel compelled to take action against BlackRock is itself a hopeful sign. It means that the political class understands that an increasing portion of the public is aware of the BlackRock/ESG/corporate governance agenda and is opposed to it. Once again, we arrive at the bottom line: the only thing that truly matters is public awareness of the issues involved in the rise of a financial (and political and technological) giant like BlackRock, and it is only general public opinion that can move the needle when it comes to removing the wealth (and thus the power) from a behemoth like the one that Fink has created. But before we wrap up here, there’s one last point to be made. You might remember that we opened this exploration by highlighting BlackRock’s position as one of the top institutional shareholders in Walmart: And in Coca-Cola: And in Moderna: And in Exxon: And in Amazon:

. . . and in seemingly every other company of significance on the global stage. Now, the fact checkers will tell you that this doesn’t actually matter because it’s the shareholders who actually own the stock, not BlackRock itself. But that raises a further question: who owns BlackRock? Now, I realize this is a lot of information to take in at once. Go ahead and re-read this series once or twice. Follow some of the many links contained herein to better familiarize yourself with the material. Share these reports with others. But if, after reading all of this you find yourself looking back over these “Top Institutional Holders” lists and saying: “Hey wait! Who’s The Vanguard Group?” . . . . . . Well then, I’d say you’re starting to get it! Good job! And don’t worry, friends, that is a question we will be exploring in these pages in the not-too-distant future. Stay tuned . . . |

Recommended Listening and Viewing

Recommended ReadingNo Evidence Freedom Convoy Donations Were From Criminal Origins: GoFundMe Exec The Great Reset: Global Elites and the Permanent Lockdown by Marc Morano Recommended ListeningFROM A LISTENER: CBDCS and the War on Your Freedom Recommended ViewingBREAKDOWN: Trucker Commission Day 31 | Trudeau testifies on final day Ft. @Tom Marazzo The Network Behind FTX with Marty Bent and Michael Krieger CBDC and the Fed’s Plan to Weaponize Money Just For FunStep 1 – Go to your local mom-and-pop used book store. Step 2 – Purchase a musty, dog-eared, well-loved copy of William Faulkner’s As I Lay Dying. Step 3 – Find a quiet spot in the woods or a nice place on the beach or a cozy spot by the fire to curl up and devour each word. Step 4 – Thank me later. |

| SUBSCRIBER DISCOUNTS

CLICK HERE to visit the New World Next Week shop and use the coupon code subscriber25 at checkout to receive a 25% discount on any Corbett Report DVD or USB (or the new Mass Media: A History online course) just for being a Corbett Report member! |

Fascinating to get a layman’s glimpse into the formation of the innermost genetically modified organs of The Transhumanist Monster Machine that’s slowly splicing humanity out of its DNA, even as it’s gestating in the global financial womb.

Historical moments in (trans) Human history indeed.

historical moments in history. 8-/

oy vay.

What a truly fabulous “recommended listening” from a fabulous Corbett listener!

I’ve only really just begun listening but it has provided to my wayward imagination a truly eloquent illustration of what “inclusion” really means.

Just as the French Revolution got more people into the debt web of the banking system based on interest rates and taxes, just as the sixties “women’s emancipation” movement got even more people directly trapped in that web, now CBDCs under cover of “inclusion” of the large swathes of unbanked populations (not only of the African continent but also the biometric banking crusade to better tax people that took place in India recently comes to mind) are linking every individual to their digital money and ultimately joining that to their DNA…?

Anyhow, a very poised and crystal clear exposé that, resting on an understanding of retail and wholesale, commercial and central bank dynamics, provides a BlackRock solid understanding of not only the system being slotted into place, but the stakes and timelines involved as well!

Thanks Corbett listener and my genuine heartfelt gratitude to the man behind the Corbett Report. Just, Wow!

Another masterpiece in the “How … conquered the World” series, thanks James!

Mr. Corbett, Thars a minor typo…

Lest their be any doubt about BlackRock’s commitment…

I’ll seize the opportunity of your comment, HRS, to signal a question I had about a word used in the text:

to the more exotic forms of data harvesting that is capable when complex learning algorithms are connected to the mind-boggling amounts of data that are now available on seemingly everyone and everything.

that are possible? become possible?

perhaps I simply don’t fully understand the sentence?

gratuitous nitpicking…?

Thank you both for the corrections. As you may have guessed, I’ve been working and re-working this text so much that a few doozies probably crept in at some point. I’ve corrected these typos, but please do let me know if there are any more.

The queen of nitpickers here…

James, you missed the “s” in Kochanski’s name in this sentence:

The task, hitherto done by hand from paper printouts, was long and arduous. Kochanki…

Also, I might be wrong, but in this sentence I think there is supposed to be an “and” after “liability:”

Aladdin (short for “asset, liability, [and] debt and derivative investment network”)…

That’s all for now. Lots of info to take in. Thank you James!

Thanks for that. In fact, it turns out Kochansky is with a “y,” not an “i.” Corrected.

The extra “and” in Aladdin is debatable. The bastion of truthiness (Wikipedia) has it, citing Forbes, but the FT article I link in here doesn’t have it. Having two “ands” like that seems ridiculous to me so I’m keeping it out unless and until someone can provide evidence of actual official BlackRock documentation that says otherwise.

NoSoapRadio,

Honestly, that is way out of my league. I only know Texan.

Maybe we need an expert in Anglo-Irish Literature that has a Canadian/Japanese perspective to answer that.

Edit…

Oh!…just as I submitted this comment, he arrived.

OOOps!! Hadn’t seen your comment before posting and even less, that of the illustrious author himself!

Anyhow, you may be an expert in Texan and to be honest, at this point, my only hypothetical expertise lies in Franglais or rather…Frenglish?

And because I’m a paranoid conspiracy theorist, I rather suspect he planted those errors in his monumental exposé deliberately just so we could render him the service of identifying them, thus enhancing our gratitude and desire to serve, the calculating weasel!!

😯

🙂

LOL ?

…that are enabled?

RE: How BlackRock Conquered the World — Part 3: Aladdin’s Genie and the Future of the World

I eat this stuff up. While it is a bit beyond my pay-grade and some points get a little foggy, I find this fascinating. Maybe I’ll get the NAC of it.

https://www.kiplinger.com/investing/esg/603451/natural-asset-companies-nacs-a-new-tool-for-esg-investors

Part 2 blew my mind. There are so many implications.

I very much look forward to any interviews with James Corbett about this Blackrock series. I think it will help in cementing concepts for me.

In Episode 433 – CBDCs: Beyond the Basics, Corbett emphasized that we damn well better learn this kind of stuff because it is right at our doorstep.

https://www.corbettreport.com/cbdc/

Do you have a 401(k) retirement plan?

For folks unfamiliar, many U.S. employers offer a 401(k) retirement plan. And many times, the employer will, in some percentage-way, match the employee’s contribution to plan.

Well, here is some bad news. The Biden Administration snuck in an ESG type of regulation for 401(k)’s during Thanksgiving week.

Read about it here…

https://www.corbettreport.com/yearzero-esg/#comment-143290

Sometimes a person can change aspects of their 401(k). Often, changes are limited to a quarter or year-ending.

In my limited experience, I wasn’t pleased with the selection of investments that the 401(k) was vested in, but there weren’t many viable options.

In a way, it is a “carrot trap”…with the employer matching a percentage of what the employee contributes every paycheck…who wants to hop away from that?

Personally, I did hop away, but that was with a mindset that we were headed towards a bear market….well, that might soon be the case in 2023. Who knows?…Blackrock?

I have one of these, but fortunately wasn’t funding it much. I had an aversion to funding it much. It was just a gut feeling that I didn’t like putting money into this since I had little control of how they were investing my money, so I have a small amount of money only. I’m wondering if I should just pull it out and take the loss and invest in something else.

I’m also doubtful of any social security at retirement for myself, which will be in about 25 years, unless I can retire early.

I’ve been dreading watching the black rock series, but am going to do it on my next day off. It seems very dark and makes me feel a bit overwhelmed especially during the holidays. People have got to figure out a way to withdraw support for this slavery system.

I’m sure I’m still supporting it in small ways with Amazon buys occasionally.

I understand what you are saying about the 401(k). It is a tough call.

When I closed mine out, I didn’t have much in it. So, it wasn’t a big-to-do.

There are a fair number of folks who expect a strong downturn in stocks during 2023.

If that occurs, everyone’s 401(k) will take a hit.

A loss of 10% requires an 11% gain to recover.

A 50% loss requires a 100% gain to recover.

A 60% loss requires an even more daunting 150% gain to simply break even.

Chris Vermeulen has often given some good advice.

See “Stage 3” of this graph. I think we currently might be in that area, but I’m no expert.

https://www.fxempire.com/forecasts/article/the-worst-case-scenario-for-retired-or-nearly-retired-investors-who-are-55-1135896

He has other articles posted at that website.

The stock market is a crap shoot, a casino economy feature of financial capitalism.

The 401K’s were also voted on by Biden back in the 70’s.

They destroyed defined pension plans.

Now, once they got you in the 401K, you cannot get out without penalties or suffer taxes in enormous amounts.

This is not investment it is robbery.

All part of the destruction of the working class.

Found a typo! “BlackRock” should be “BlackArts”.

Brilliant series. I think their empire has already started to collapse. Ethical? Social? They are desperate, and people are starting to take notice, even if too many still have their heads firmly stuck in the sand.

The problem is over accumulation of capital. The ruling class has nothing to invest in but phony climate credits and digital life.

And a rising surplus labor army of unemployed and never to be employed is their biggest problem.

We are entering a stage of repressive accumulation where profits are fictitious and repression of the surplus labor, us, is also a profitable industry.

Thus, the rulers get a twofer. They get to profit off fictitious capital while profiting off our incarceration.

Blackrock very much reminds me of Robert Vesco’s IOS.

This was a holding tank for all monies made legally and mostly illegally.

One can look at Spooks by Jim Houghan to find it.

All paper money eventually returns to its intrinsic value. Zero

–Voltaire

“We have no compassion and we ask no compassion from you.

When your turn comes, we shall not make excuses for terror.

But the royal terrorists, the terrorists by the grace of God and the law, are in practice brutal, disdainful, and mean, in theory cowardly, secretive and deceitful, and in both respects disreputable.”

Karl Marx, final editorial in the Neue Rheinische Zietung

Revolution is all that can stop them but unfortunately, the subjective mind cannot embrace the collective power we have and how to use it to achieve individual freedom.

I wonder if Aladdin is as clever as Meta’s Galactica, the science language AI platform that started churning out nonsense about bears in space…

https://www.technologyreview.com/2022/11/18/1063487/meta-large-language-model-ai-only-survived-three-days-gpt-3-science/

BlackRock closes ESG fund due to lack of interest – a shaft of light in the darkness?

https://citywire.com/za/news/blackrock-closes-esg-fund-due-to-lack-of-interest-amid-poor-performance/a2382697

“BTW did you know the search bar doesn’t show up on the mobile friendly Corbett page.”

I don’t use the mobile version, but I read here that the search bar can be found somewhere at the bottom of the page (not the top).

The Black Rock that transforms…

In this sentence, “In doing so, researchers must recalibrate and refine the model, to make sure it was adding value and not just rediscovering well known market behaviors already know by ‘fundamental’ fund managers.”, shouldn’t the last part read “already known by…”? Of course, this being a quote, the origin of the typo (if it is a typo) could be the source material, which is often indicated by adding (sic). I hope I understand the sentence well.

“…Of course, this being a quote, the origin of the typo (if it is a typo) could be the source material…”

Yes, the typo is in the original. Not sure of the utility of “sic” here even if it’s customary.

Wanton use of “sic” is not necessarily desirable as described in this link:

https://stancarey.wordpress.com/2014/04/29/the-pedantic-censorious-quality-of-sic/

Sic – not an abbreviation but a Latin word meaning thus or so – can usefully clarify that a speaker said or wrote just as they are quoted to have done. But it can also serve as a sneer, an unseemly tool to mock a trivial error or an utterance of questionable pedigree…”

Or perhaps you were being facetious?

I just see it as a way to dispel doubt about a typo. I know it can be used ironically. Not really important. Thanks

“I know it can be used ironically.”

I actually didn’t until I saw the doc about it.

Thank you both. I have gone ahead and added the [sic].

You end the article with a few paragraphs about who owns Blackrock. The owners of Blackrock own an asset management firm, not the assets themselves.

Blackrock is hired by institutions like the Japenese Government Pension Fund to manage its assets. The pension fund hires Blackrock to accomplish the pension fund’s goals. Pension funds dislike risk, instability and waste. They love expensive restaurants, social pretense, and pensioners who live less long than expected.

Working people who give money to financiers to extract exponential gains from the world place their own interests above that of future generations. It is a corrupt enterprise in its very nature.

Take all your money out of the stock market.

Antimicrobial Resistance – The Silent Pandemic – deep dive from Citi

https://ir.citi.com/gps/_r3D4IqDgtNaSpCqBE-TlNEcQnbZhau9VrmfwewTf1s5wyTR3FglK0R5lzGHJyQ9xVODpvw6bcpQzt15Wd2bdUZJJOlAO6-Og11xR8f58CFMiw5q-QxYKA%3D%3D

It’s scary that the largest asset managers, many with good reputations for serving their customers well, are signatories to the “The Net Zero Asset Managers Initiative”. The good news, for folks who invest, is that some of the best big managers are absent from the list. For example, Dodge & Cox and Mairs & Power. These are US companies but I think also accept international clients. Perhaps readers here will suggest others.

As I’m reading:

The “so what” here is that—as Fink signals in his latest letter—BlackRock will be putting ESG reporting and compliance in its basket of considerations when choosing which stocks and bonds to invest in and which ones to pass over.

The result is that major corporations are “programmed” to take actions at all costs. We’ve seen it with Pharma complex with the contrivance of a preplanned pandemic, but we also see it in other ways as major corporations latch on and make their contributions to the crap in (In other words, ESG is a set of phoney-baloney metrics that are being cooked up by globalist think tanks and would-be ruling councils (like the World Economic Forum) to serve as a type of social credit system for corporations) programming that can only make things come to a head, to get to the end they have sought to pass off onto “machines” so they can survive any failure.

The 21 trillion is strikingly similar to the missing money from pentagon funds. Enjoyable read, I continue…

“Mr. McCombe’s letter asserts compliance with our fiduciary laws because BlackRock has a private motivation that differs from its public commitments and statements. ”

I believe that is the definition of a Racket. Indeed, it is all a racket, the military being huge, but only a part of the whole.

It really calls into question: Who can investigate and hold those accountable who wield so much control?

This is a Solution worth coming towards.

Looking forward to more of the same with Vanguard. everything you buy sends money to one of these companies. It’s way beyond monopolization, but it’s that at its core.

Really, really superb work, James. Very impressive.

In terms of who are BlackRock’s “fellow travelers,” I hope you name names. Along the lines of Sun Tzu’s “The Art of War,” how can you defeat your opponent if you don’t understand their psychodemographics?

BlackRock’s board today virtue-signals diversity, but in March 2020, it is my understanding the board was Larry Fink, Robert Kapito, Robert Goldstein, Ben Golub, Gary Shedlin, Derek Stein, Mark Weidman, and Mark Wiseman.

$10 trillion asset manager BlackRock Paris headquarters taken over by protestors. (8:01 AM · Apr 6, 2023)

https://twitter.com/multifymedia/status/1643946963140739072?s=20

“BlackRock Paris headquarters has been TAKEN OVER by protestors”

https://www.youtube.com/watch?v=bMtX6hxltBc

What happened to the image under “But that raises a further question: who owns BlackRock?” – as I’d like to know what the answer was?

Responding to Diottica’s concern, Blackrock is a publicly traded corporation under the symbol BLK. Ownership information is available from various sources, including Morningstar (at least if you have a subscription.) The 20 largest owners of Blackrock are shown at https://archive.is/7OsBy The top two are Vanguard funds.

Gee, the libertarian capitalists found out how the world has ben monopolized. Good. Waking up is good.

Class consciousness is a necessity.

Now, what are you going to do about it?

You do not believe in organizing so what individual solutions do you have for a financialized monopoly capitalist system?

Go to a local vegetable dealer?

Capitalism, the rentier society (FIRE) owns the world and you can buy a plot of land and sit on it but that is all you will do — and eat if possible.

Organized opposition to monopoly transnational capitalism is the goal.

Seeking individual solutions to social problems is more than fantasy, it is delusion