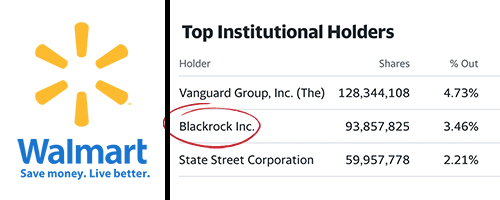

Let’s play a little game.

Let’s imagine you’re Joe Q. Normie and you need to run out for some groceries. You hop in the car and head to the store. What store do you go to? Why, Walmart, of course!

And, being an unwitting victim of the sugar conspiracy, what do you buy when you’re there? Coke, naturally!

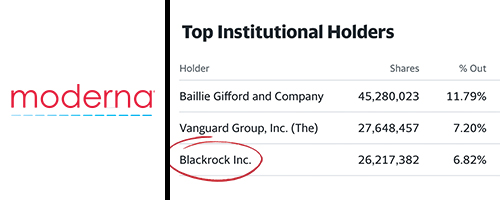

And you can get jabbed at Walmart these days, right? Well then, you might as well make sure you get your sixth Moderna booster while you’re there!

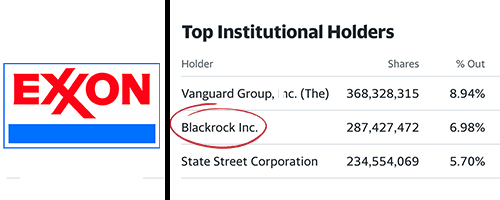

And don’t forget to fill up with gas on your way home!

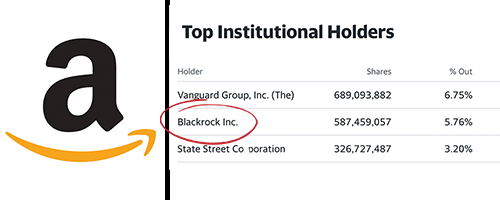

Is this creeping you out? Then why don’t you shut yourself in your house and never go out shopping again? That’ll show ’em! After all, you can always order whatever you need from Amazon, can’t you?

Are you noticing a pattern here? Yes, in case you haven’t heard, BlackRock, Inc. is now officially everywhere. It owns everything.

Sadly for us, however, the creepy corporate claws of the BlackRock beast aren’t content simply to clutch onto a near plurality of the shares of every major corporation in the world. No, BlackRock is now digging its talons in even further and flexing its muscles, putting that inconceivable wealth and influence to use by completely reordering the economy, creating scamdemics and shaping the course of civilization in the process.

Let’s face it: if you’re not concerned about the power BlackRock wields over the world by this point, then you’re not paying attention.

But don’t worry if all of this is news to you. Most people have no idea where this investment giant came from, how it clawed its way to the top of the Wall Street dogpile, or what it has planned for your future.

Let’s fill that gap in public understanding. Over the course of this investigative series, you’re going to get a crash course in the creepiest company you’ve never heard of.

This week I will give A Brief History of Blackrock and describe how it came to be the economic and political juggernaut it is today.

In Part 2 of this series, we will examine how BlackRock’s Going Direct reset paved the way for the massive economic and monetary transition that we have just lived through under the cover of the scamdemic.

And in Part 3, we will examine the Aladdin system and the other creepy ways BlackRock is planning to use its power to mould society in its own interest.

To access this week’s edition of The Corbett Report Subscriber, please sign in and continue reading below.

Not a Corbett Report member yet? Sign up to BECOME A MEMBER of the website and read the full newsletter or CLICK HERE to access the editorial for free.

|

The Corbett Report Subscriber

|

vol 12 issue 31 (November 13, 2022)

|

by James Corbett PART 1: A BRIEF HISTORY OF BLACKROCK“Hold on a second,” I hear you interject. “I’ve got this! BlackRock was founded as a mergers and acquisitions firm in 1985 by a couple of ex-Lehmanites and has since gone on to become the world’s largest alternative investment firm, right?” Wrong. That’s Blackstone Inc., currently headed by Stephen Schwarzman. But don’t feel bad if you confuse the two. The Blackstone/BlackRock confusion was done on purpose. In fact, BlackRock began in 1988 as a business proposal by investment banker Larry Fink and a gaggle of business partners. The appropriately named Fink had managed to lose $100 million in a single quarter in 1986 as a manager at First Boston investment bank by betting the wrong way on interest rates. Humbled by this humiliating setback (or so the story goes), Fink turned lemons into lemonade by crafting a vision for an investment firm with an emphasis on risk management. Never again would Larry Fink be caught off guard by a market downturn! Fink assembled some partners and brought his proposal to Blackstone co-founders Pete Peterson and Stephen Schwarzman, who liked the idea so much that they agreed to extend Fink a $5 million line of credit in exchange for a 50% share in the business. Originally named Blackstone Financial Management, Fink’s operation was turning a nice profit within months, had quadrupled the value of its assets in one year, and had grown the value of its portfolio under management to $17 billion by 1992. Now firmly established as a viable business in its own right, Schwarzman and Fink began musing about spinning the firm off from Blackstone and taking it public. Schwarzman suggested giving the newly independent company a name with “black” in it as a nod to its Blackstone origins and Fink—taking roguish delight in the inevitable confusion and annoyance such a move would cause—proposed the name BlackRock, saying, “You know if we do something like this, all of our people will kill us.” The two evidently share the same sense of humour. “There is a little confusion [between the companies],” Schwarzman now concedes. “And every time that happens I get a real chuckle.” But a shared taste for causing unnecessary confusion was not enough to keep the partners together. By 1994, the two had fallen out over compensation for new hires (or perhaps due to distress over Schwarzman’s ongoing divorce, depending who’s telling the story), and Schwarzman sold Blackstone’s holdings in BlackRock for a mere $240 million. (“That was certainly a heroic mistake,” Schwarzman admits.) Having made the split with Blackstone and established BlackRock as its own entity, Fink was firmly on the path that would lead to his company becoming the globe-bestriding financial colossus that it is today. In 1999, with its assets under management standing at $165 billion, BlackRock went public on the New York Stock Exchange at $14 per share. Expanding its services into analytics and risk management with its proprietary Aladdin enterprise investment system (more on which in Part 3 of this series), the firm acquired mutual fund company State Street Research & Management in 2004, merged with Merrill Lynch Investment Managers (MLIM) in 2006, and bought Seattle-based Quellos Group’s fund-of-hedge-funds business in 2007, bringing the total value of assets under BlackRock management to over $1 trillion. But it was the Global Financial Crisis of 2007—2008 that catapulted BlackRock to its current position of financial dominance. Just ask Heike Buchter, the German correspondent who literally wrote the book on BlackRock. “Prior to the financial crisis I was not even familiar with the name. But in the years after the Lehman [Brothers] collapse [in 2008], BlackRock appeared everywhere. Everywhere!” Buchter told German news outlet DW in 2015. Even before the Bear Sterns fiasco materialized into the Lehman Brothers collapse and the full-on financial bloodbath of September 2008, Wall Street was collectively turning to BlackRock for help. AIG, Lehman Brothers, Fannie Mae, and Freddie Mac had all hired the firm to comb through their spiraling mess of credit obligations in the months before the meltdown. BlackRock was perceived to be the only firm that could sort through the dizzying math behind the complicated debt swaps and exotic financial instruments underlying the tottering financial system and many Wall Street kingpins had Fink on speed dial as panic began to grip the markets. “I think of it like Ghostbusters: When you have a problem, who you gonna call? BlackRock!” UBS managing director Terrence Keely told CNN at the time. And why wouldn’t they trust Fink to pick through the mess of the subprime mortgage meltdown? After all, he was the one who helped launch the whole toxic subprime mortgage industry in the first place. Oh, did I forget to mention that? Remember the whole “losing his job because he lost $100 million for First Boston in 1986” thing? That came just three years after Fink had made billions for the bank’s customers by constructing his first Collateralized Mortgage Obligation (CMO) and almost single-handedly creating the subprime mortgage market that would fail so spectacularly in 2008. So, depending how you look at it, Fink was either the perfect guy to have in charge of sorting out the mess that his CMO monstrosity had created or the first fink who should have gone to jail for it. Guess which way the US government chose to see it? Yes, you guessed right. They saw Fink as their saviour, of course. Specifically, the US government turned to BlackRock for help, with beleaguered US Treasury Secretary Timothy Geithner personally consulting Larry Fink no less than 49 times over the course of the 18-month crisis. Lest there be any doubt who was calling the shots in that relationship, when Geithner was on the ropes and his position as Secretary of the Treasury was in jeopardy at the end of Obama’s first term, Fink’s name was on the short list of those who were being considered to replace him. The Federal Reserve, too, put its faith in BlackRock, turning to the company for assistance in administering the 2008 bailouts. Ultimately, BlackRock ended up playing a role in the $30 billion financing of the sale of Bear Stearns to J.P. Morgan, the $180 billion bailout of AIG, and the $45 billion rescue of Citigroup. When the dust finally settled on Wall Street after the Lehman Brothers collapse, there was little doubt who was sitting on top of the dust pile: BlackRock. The only question was how they would parley their growing wealth and financial clout into real-world political power. For Fink, the answer was obvious: move from the petty crime of high finance into the criminal big leagues of government. Accordingly, throughout the last decade, he has spent his time building up BlackRock’s political influence until it has become (as even Bloomberg admits) the de facto “fourth branch of government.” When BlackRock executives managed to get their hands on a confidential Federal Reserve PowerPoint presentation threatening to subject BlackRock to the same regulatory regime as the big banks, the Wall Street behemoth spent millions successfully lobbying the government to drop the proposal. But lobbying the government is a roundabout way to get what you want. As any good financial guru will tell you, it’s far more cost-efficient to make sure that no troublesome regulations are imposed in the first place. Perhaps that’s why Fink has been collecting powerful politicians for years now, scooping them up as consultants, advisors and board members so that he can ensure BlackRock has a key agent at the heart of any important political event. As William Engdahl details in his own exposé of BlackRock:

And it doesn’t end there. When it came time for Biden’s handlers to appoint the director of the National Economic Council—responsible for the coordination of policymaking on both domestic and international economic issues—naturally they turned to Brian Deese, the former global head of sustainable investing at BlackRock Inc. Indeed, by 2019, BlackRock’s ascension to the height of political power was complete. At the same time that the World Economic Forum was appointing Fink as a member of its Board of Trustees, then-presidential candidate Joe Biden was making the pilgrimage to Wall Street to beg for BlackRock’s support in the fight against Trump. “I’m here to help,” Fink reportedly assured Biden. And the rest, as they say, is history. . . . or, more accurately, is the present. Because when we peel back the layers of propaganda from the past three years, we find that the remarkable events of the scamdemic have absolutely nothing whatsoever to do with a virus. We are instead witnessing a changeover in the monetary and economic system that was conceived, proposed and then implemented by (you guessed it!) BlackRock. And that, ladies and gentlemen, will be the focus of Part 2 of this exploration. Stay tuned! . . . |

Recommended Listening and Viewing

Recommended ReadingU.S. Gov Quietly Declassifies Post-9/11 Bush / Cheney Interview + (link to document) Lab-grown meat & nuclear yeast vats: COP27 reignites the war on food Recommended ListeningEpisode 31- ’Unvaccinated’ and the Propaganda of Presumption Recommended ViewingFROM A LISTENER: A Conversation with Stuart J Hooper: an Overview of the Military-Industrial-Complex FROM A LISTENER: TipToe To Tyranny: Chapter 1 First Steps Former CIA Director John Brennan Confronted on Torture, Drone Bombings, Surveillance Just For Fun |

| SUBSCRIBER DISCOUNTS

CLICK HERE to visit the New World Next Week shop and use the coupon code subscriber25 at checkout to receive a 25% discount on any Corbett Report DVD or USB (or the new Mass Media: A History online course) just for being a Corbett Report member! |

even as their name would suggest!

(sorry, just jokin’ around, going in circles during the deadseason or at least dying one.

I think it’s the coffee and cigs…or just tryin’ to resist the insistant siren call of netflix on this now decidedly grey day of lethargy…)

@deadseason

??? ???????? ????? seems like it is the current banner/vehicle carrying forward the financial interests of the multi-generational oligarchic families of the central banking cartel, royals and chemical manufacturers (my preliminary research indicates majority share holders/owners include Rothschild Investment Corp., Italian Orsini family, the American Bush family, the British Royal family, the du Pont family, the Morgans, Vanderbilts and Rockefellers.)

I do not know if Vanguard and Blackrock are just two names for vehicles that are part of the same ‘plutocratic economic blitzkrieg’ (both being controlled by the same people, but appearing to be separate, providing a smokescreen for oligarchs that do not like being in the spotlight) or if they are separate entities entirely (waging distinctly different forms of economic warfare) and representing distinctly separate individuals with separate goals.

One thing is for sure though, when it comes to the scamdemic, both Vanguard and Blackrock worked hand in glove for profiteering from the destruction of small businesses (hyper-consolidation of wealth via their corporate investments), pushing the bio-weapon injections and advancing the digital control grid (closer to being able to put a choke hold on anyone that is dependent on centralized infrastructure). So, if those entities (Blackrock and Vanguard) do represent the interests of separate people, they apparently share goals, methodology and modus operandi when it comes to their use of psyops, biological warfare agents and governments as pawns to accomplish their intended “Full Spectrum Dominance”.

Thus, since their modus operandi is the same, the solutions that empower us to starve, dismantle and render such abominations obsolete (and leave them behind) are also the same.

You make good points. They are all part of the trans-global cartel system that corporations have put together.

Their job, of course under capitalism, is to maximize profits. Period.

Their job is not to assure you have work, homes, opportunities, education etc.

Fascism was a result of cartelization in the early 1900’s.

So they moved overseas.

Now, financial global capitalism is so huge, they are themselves countries.

For the government is just a managerial class for elites.

The real power behind the synarchy are the transnational corporations.

Welcome to the age of Dominance.

Master-slave

Lord-serf

Employer-employee

The history of the human world is the history of class struggle and you will notice Berkshire on the list for Buffet understands. As he noted 11 years ago:

‘My Class Has Won’ And ‘It’s Been A Rout’

https://www.huffpost.com/entry/warren-buffett-tax-code-l_n_1095833

And why is it that the ruling class understands the dynamics of class struggle but the working class and victims of financial capitalism do not?

Simple. No education.

With Beavis and Butthead is the mascot for the culture, you eventually just might see America sold on the Antiques Road Show to the same cartels that destroyed it.

Fascism is just communism with the Jewish cultural baggage taken out and replaced with the local Ethnic one.

It’s not a reactionary or conservative force, but a revolutionary one, at least in Itallian and German varieties. Ever looked into South American flavors so can’t say what they are like

Hmmmm… why do visions of being blockchained and bitcoined to a blackrock hover before me…?

@nosoapradio

As I understand it, blockchain is a separate thing from bitcoin. Bitcoin may utilize (and be based on blockchain) but blockchain is a system that can be used for either creating/facilitating decentralized transaction/data storage systems or be weaponized to create hyper-centralized oligarch controlled transaction/data storage systems (intended to create “digital concentration camps” as Catherine Austin Fitts calls them) like CBDCs etc.

Though, I am no expert on cryptocurrencies or blockchain tech, so I could be way off with that.

Personally, while many of the characteristics of decentralized blockchain currencies appeal to me at first glance, I still trust the depending on living economy of the Earth more than I do ones and zeroes on a computer hard drive for ensuring I have the means to provide basic necessities for myself and my loved ones so that is where I put the majority of my energy.

Well, Gavinm, as I understand it there are public and private blockchain systems and Bitcoin is based on a permissionless (public) system offering pseudo-anonymity and CBDCs would either be based on private blockchain systems offering no anonymity (as you’d need to provide all your data to participate and be “permissioned” into the system) or based on a non-blockchain system that would be equally devoid of anonymity. But in reality, I don’t know diddly squat about any of this.

The glib reference to Bitcoin was only because I’d just seen some passing articles about BlackRock being instrumental in buying up some 185 Bitcoins.

In reality, whatever the exact nature of the digital money that will be put into circulation by BlackRock, with the blessing of Carstens the big BIS guy, it’ll be the infamous CBDCs adopted by governments everywhere.

At least, so it would seem. But I’ll stay tuned for the next captivating Corbett clarification!

and I probably never tried hard enough but I’ve never understood how a permissionless system could not be vulnerable to essentially being bought up by colossal fortunes and hijacked which is what, for a flash, I imagined the Fink at BlackRock doing to Bitcoin (instead of simply stigmatizing the crypto out of existence which would have left it open for use by marginals like us as an alternative/parallel monetary system.) More effective to take control of it, use the aspects that have proven effective as a prototype and discard the rest.

But I reiterate, I have no idea what I’m talking about.

But Catherine Austin Fitts, who you paraphrased does. I should watch/read more of her and Titus.

But the clock just struck Happy Hour so it’s time to celebrate the new imminent work week!

@nosoapradio

Sounds like you have a more comprehensive understanding of the nuances of blockchain tech, it’s current uses, potential uses and it’s dark alternatives than I.

Speaking of BIS, I would be interested in mapping out all the interlocking points that connect Blackrock, Vanguard and the BIS.

My little brother is a city guy and tech specialist that was into cryptocurrency in a big way, managing groups that “mine bitcoin” (whatever that means) and making investments in other cryptocurrencies. He tried to suggest I invest but I told him “look man, all I know is that human markets, currencies and systems rise and fall, expand and collapse but nature’s living economy has persisted for eons with relative stability. If I plant a seed in the rich earth and tend to that investment I will get food, medicine and (usually) hundreds to thousands of seeds that can in turn be planted the following year exponentially increasing the value that can be accessed by myself and others. This equation and living economic model of Mother Earth (that provides exponential abundance to those that steward her living systems) was the same for our ancient ancestors and will be the same for our distant descendants as it is now. It requires getting one’s hands dirty, it requires sweat, blood, tlc (and sometimes tears) but it is an investment I can trust as it is built on the living architecture of creation, natural law and living systems that have been around a lot longer than humans and their systems.”. He said he can’t argue with that but thinks he does not have a ‘green thumb’ (which is another way of saying “I am not willing to put in the time and energy to learn from trial and error how to cultivate skillsets outside my comfort zone related to gardening”). Oh well, to each their own.

I feel grateful that my day job allows me to put some of my time and energy into planting trees that can contribute towards facilitating the growth of the ancient living economy of Mother Earth, but in the end I still get paid in fiat, routed through the central banking cartel’s subsidiary systems, which is taxed by various parasitic involuntary governance entities and continues to feed into the oligarch’s parasitic empire each time that fiat currency changes hands. One day I hope to abandon that form of monetary exchange all together, but I still a ways to go before my wife and I can live that way (comfortably).

Thanks for the comments, wishing you a prosperous and easy going work week ahead. 🙂

BLOCKCHAIN IS INHERENTLY BIAS DUE TO UNEQUAL OWNERSHIP, NO MATTER WHAT FORM IT TAKES, A DIGITAL ECONOMY IS SLAVERY. DECENTRALISED IS A MISNOMER. THE LEDGER DOES NOT NEED TO BE ALTERED AFTER THE FACT WHEN THEY CAN ENACT BIAS ON IT AS IT’S BEING WRITTEN…THINK SUPERCOMPUTER, BUTTERFLY EFFECT(LORENZ ATTRACTOR), DETERMINISTIC CHAOS…IMPORTANT TO NOTE INTEL BUILT BACK DOORS INTO ALL THEIR CHIPS FOR MORE THAN 15 YEARS. INTERNET IS NOT A VIABLE OPTION FOR HUMAN UTILITY, IT WAS CREATED BY THEM FOR THIS VERY PURPOSE.

I wait with great anticipation for James’s next 2 parts on this…(gonna read this one again while i wait ;D), you’re a living legend James, you have the support of forces unbeknownst to us all.

Bitcoin is only anonymous if you never buy any in your own name or do a purchase in your own name or otherwise link your actual self to your wallet

As I understand it every transaction that has ever happened is stored in the bitcoin blockchain and anyone can read it.

And if you look up the owners of Vanguard, You find… Blackrock as the biggest shareholder…

I don’t know where you’d look that up, but I know Vanguard is owned indirectly by the investors in its mutual funds (and ETF’s?). Blackrock probably owns little or none of that. But thru backchannels, perhaps they have control?

Vanguard owns majority stock of Blackrock (or perhaps it’s vice versa, I don’t recall but I’m sure JC will get to it). The creepiest thing of all that when you get to the top of that tree the owner/directors of Vanguard (or Blackrock) are anonymous. Any guesses…?

Ever notice that it’s always Jews who are running everything? Ever noticed Wikipedia always seems to make sure the fact that they are Jewish is ALWAYS mentioned? As if they are so vastly different from other Americans or other countries that they must always add it to their bio?

Pdtam

Actually your will need to download the wikijew database soon since “early life” made so many people realize that it’s almost “every single time” when you look up a person of note.

I recall when I saw the picture chart of how many news people were Jewish, then one of how many bankers were Jewish, and how many Bolsheviks and how many antifa and….. well you get t he idea. I was like how can 1 % of the population be showing up 70 or 80 % of the time

You do not see those charts much these days but I still do “early life”

So are yous saying you think that 1% cited is incorrect and it’s much more or really we are the 99% and that 1% in control by a certain race of people who just so happen to make up 1%? I do think it can be myopic to just attribute the blame to one group of people though as all different types of people have caused us to get where we are and greed really is the commonality between them all.

Thank you for tackling Blackrock with this exposé series James.

I am looking forward to seeing what you dig up on the Alladin system.

In the future, I think I will attempt to cross reference the list of corporate contractors, military/intelligence R&D outfits/shell companies and oligarchs that I have found to be involved in what historian Richard Dolan refers to as “The Breakaway Civilization” with Blackrock’s investments and key players to see how much correlation exists between the two.

Given the pervasive influence and ownership of entities like Blackrock in the food, medical, military, telecommunications and even real estate industries I suppose the only way to effectively resist and boycott Blackrock is to embrace radical decentralization (and reclaiming our sovereignty) in all aspects of our lives. Perhaps we can see this imperative for decentralizing the means to produce our basic necessities locally (to avoid being caught up in Blackrock’s economic dragnet and avoid feeding into it’s web of parasitic corporations) as an impetus that is a blessing in disguise (at least for those that are educated, realize the stakes, and are up to the challenge) as it invites those that are capable to become their best selves.

Here is to those that are courageous enough to raise their gaze from the ground, see the goliath standing before us and take the necessary steps to bring it to it’s knees. May your actions serve to awaken and galvanize the sleeping/complacent masses, inviting them to ‘rise from slumber in unvanquishable number’. May you reap the harvest from the seeds that you sow and one day find yourself living in a community filled with self-governed, self-aware, courageous, integrous and creative individuals that live lives of purpose and meaning (guiding their actions in alignment with natural law).

Thanks again for shining a light on this particular ‘goliath’ in our midst.

I imagine by now, the noble, relentless and veil-piecing works of James Corbett are on the plutocrat’s radar. Thus, I would like to invite anyone reading this now to join me in a prayer to ask God (and those that work closely with Creator that watch over, protect and guide humanity) to provide a ‘hedge of protection’ around James and those close to him.

I have found that if one chooses actions that are in the interest of protecting those that cannot protect themselves, giving a voice to those that cannot speak for themselves, offering pathways to healing, empowerment, hope and unification of our family of humanity (as James Corbett has been doing for years) there are beings that stand at the ready in higher realms that are willing and able to provide protection and guidance.

While I do believe that each of us have a pre-determined time when we have agreed to leave this Earth (and no amount of prayer or will power will extend that time frame) the time we do have here can be drastically improved and our efforts supported in meaningful ways through genuine, open-hearted prayer/meditation. The Creator of all things does not interrupt or override our free will, but when invited to be part of our lives on Earth, all things become possible.

I therefore ask that the Creator of all things send emissaries to stand guard, surrounding James and those close to him in an impenetrable shield of light, protecting against any and all that would wish him harm, so that he may continue to do his important work in service to our human family.

So it is, and so it shall be.

I will accept your invitation Gavin. Adding only the one qualification that I include with all my prayers these days. That being that not my will be done but His.

I was recently exhorted to pray for our nation, (the U S.) and for the state of Israel. This caused me a bit of consternation because I see the unfolding of history that indicates to me that we are drawing close to the end days and frankly I am looking forward to the the end of suffering, injustice and death.

However I can’t forget that with the end of this age comes the closing of the door of opportunity for humanity to accept the gift of salvation. And as much as I might seem to dislike most people, I do truly love humanity.

Ultimately I agreed to pray for these nations. But with the caveat that I cannot understand His plan and that God’s will be done.

My prayer is for a hedge of protection and God’s blessings for James but mostly that God draws him to Himself. Just as I try to remember to pray for everyone.

As far as I know, both Blackrock and Vanguard manage investments for other people.

For example a Dutch pension fund will pay Blackrock to manage its investments. So then Blackrock manages $100 million, but it doesn’t own those $100 million. (For a list of investment firms used by the largest Dutch pension fund, see https://www.abp.nl/images/overzicht-externe-managers.pdf)

Or take Vanguard’s popular VWRL “all world” mutual fund. Even the smallest investor can buy VWRL. It tracks the value of the entire stock market. The fund is managed by Vanguard, but the money belongs to the individual investors.

John C. Bogle founded Vanguard to provide “low-cost index funds for the long-term investor”. Many individuals did very well by his advice. See for example the incredibly active https://www.bogleheads.org/ internet forum.

At least regarding Vanguard, you are correct. But part of “managing” is to vote for corporate directors and decide major corporate policies. There’s no mechanism for the beneficial owner, the small investor, to be exert any control.

That’s true, investors with Vanguard give up their voting rights. Few small investors would visit a shareholder meeting if they owned the shares. And institutional investors can pressure Vanguard itself, or move their capital elsewhere. So I wonder how much difference this makes.

That’s the part I’m trying to understand… (I’m financially challenged) Why do people say that Blackrock, Vanguard, etc “own” all those companies when, as far as I can tell, they manage the shares owned by other people. What’s the trick/loophole?

Thanks for any pointer in the right direction!

Found the answer myself…

https://www.investopedia.com/ask/answers/185.asp

Woolfolk wrote a book 1890 about the money kings, back then they acted openly in the spotlight before they noticed it might be better in the hidden. He writes about several families but the main family of the money kings is sure the Rothschilds, having over half of the planets wealth in 1890 i would guess it is not less by now but perfectly hidden in infinite companies, subsidaries, etc or such mega wallets like Blackrock and Vanguard.

No matter what its a very interesting read even 130 years of age.

https://archive.org/details/LondonMoneyPowerGreatRedDragonWoolfolk1890

“The great red dragon or London money power” by L. B. Woolfolk

Always a great read. Love the detail and background. Always think there is a layer before each layer and wonder who the fink fronts for, and before them…

Truth is stranger (and so much more interesting!) than the fiction that is television.

Are we in a technocracy? Is there a borg in charge, feeding scripts to the once-young, now old “leaders” of today? It’s difficult to explain the direction of things and the willful ignorance of humanity any other way. Did they already make a switch? There is no humanity behind the one unison of scripted pronouncements from their ilk.

RE: How BlackRock Conquered the World — Part 1: A Brief History of BlackRock

Oh man! This is good. Really good. I can’t wait for Part 2.

With the coming economic conditions in 2023, I’m sure we all will be recollecting this series.

This would make an excellent documentary as well.

I agree.

Visuals help to cement mental concepts.

The way Corbett tells the story in this article is real…it communicates to the average person.

Frode,

You nailed it! Sept 19, 2023 Corbett releases the VIDEO version.

HomeRemedySupply,

Wonderful. I am excited and am looking forward to watching the documentary.

This article reminds me of…

MONOPOLY – Who owns the world? – Tim Gielen

https://odysee.com/@Turricano:5/Monopoly-Who_Owns_The_World:9

James Corbett had it linked under the “Recommended Viewing” with his October 11th article

Breaking the News: How the First Media Moguls Shaped History.

https://www.corbettreport.com/breaking-the-news-how-the-first-media-moguls-shaped-history/

had to keep scrolling til finding that, finally somebody, thanks HRS. The monopoly “doco” is so last year,, but it did leave me with the same query that a few have mentioned above and deserves full scrutiny: does Larry own fink while fink owns larry? could Knif Yrral play a part?

seriously we need an accountant versed in spherical logic here, there will be a slanderous name for such egregious manipulation of trust: if black rock and vanguard together own the majority of mega corporations,, and but they also both own the majority of each other, what does that mean? it should prove or illustrate something? I like to think of circular logic as relativist shyte, the example Ive posted here before (apologies) is:”I must tell the truth, everything I say i a lie”. but this ownership game will have a trail to track. people decided and acted. What does that ledger look like? who pays who? and when? and do they pay each-other or anyone anything? or do they just fire ones and zeros at each other? how would they settle a divorce? who gets the last musical chair? maybe there never were any relative chairs, just quantum chairs?

and for those hankering for the cosmic angle: Jose Arguelas was a student of mayan mysticism, (studied, wrote, spoke about it) He reckoned that the Mayans had a name for the center of the galaxy “Hu nab ku”. (big claim considering their physical telescopes were windowless but roofless 4-5 story towers,,) and but what did he say Hu Nab Ku was? ,,,, wait for it:

a black cube

this is a brief rave on the name, but the cube theory may be hard to source,; I have that from a woman who was close to Jose in aus & NZ during the last decades of his life.

https://www.galacticresonance.org/hunab-ku-mayan-galactic-center/

I actually got a couple students to watch parts of that documentary, Monopoly in an effort to create some lively ESL discussion. That was before I was formally ordered for the second and LAST TIME to immediately cease and desist evoking anything even vaguely resembling conspiracy theories during my classes, they’d received feedback… That was a while back now… think I’ll have another looksee myself in preparation for the next installment of this BlackRock series.

Yea! I remember Nogales!! And you gotta good memory, as the passenger of a motorbike I used to head up to Mount Lemmon, for example, and we’d sit on ledges exactly like the one here to watch the birds of prey soaring and circling over the green and arid landscapes… and I remember the drastic temperature change as we wound our way up the mountain, how chilly it got in comparison to the desert and then vice versa… oooh whyyyyy did I leeeave…??? sigh.

https://www.narcity.com/mount-lemmon-in-arizona-has-hiking-trails-with-some-of-the-best-views

Now I’ve got Solsbury Hill in my mind’s ears…

Nosoa Pradio

Oh where are’t thou? Are you leading the coup in Africa?

Miss your keen dialogues for they are needed now more than ever. An ever judicial insight is/was your past/present byline. I would be hanged a second time to embrace your judicial elacution, cyphering the mysterious nonsense I contrive.

A judgement sentence aimed my way is worth die’n for, twice. But I digress. The eyes are what I want playKated as of late.

You Almost brought as much as Broc West brings to this picnic, with his honest visual integrity in every well placed frame. Your soliloquies as ever, pained or soothing to the minds eye framed reasoned pictures, dazzling the senses, like ravishing love,in a time of cholera or appeasement. Come back Dorothy, the crowd sighed as you floated away. Come back.

I loudly echo the sentiment, but can’t phrase it with the poetic French way which you use GBW.

I miss ManBearPig.

HRS

Oui monami

And if I’m not mistaken if you look t the owners of Blackrock who shows up? Vanguard…

Vanguard is the largest owner of Blackrock common stock, having about 11%. I’m pretty sure that Blackrock doesn’t own or formally control any Vanguard stock.

“Remember: You are powerful. You are beautiful. And you are free. Peace.” -Derrick Broze

I swear…that dude is involved in so many things. He sure ain’t scared to get his hands dirty.

What a great, real life confrontation. See Corbett’s “Recommended Viewing” below the article…

Former CIA Director John Brennan Confronted on Torture, Drone Bombings, Surveillance (9 minutes)

Broze helps to groove us in on some of Brennan’s history.

Michael Hastings comes up.

See Corbett’s

Episode 274 – Crashes of Convenience: Michael Hastings

https://www.corbettreport.com/episode-274-crashes-of-convenience-michael-hastings/

Michael Hastings was that rarest of breeds: a mainstream reporter who wasn’t afraid to rail against the system, kick back against the establishment, and bite the hand that feeds him. On the morning of June 18, 2013, he died in a fiery car crash. But now details are emerging that he was on the verge of breaking an important new story about the CIA, and believed he was being investigated by the FBI. Now even a former counter-terrorism czar is admitting Hastings’ car may have been cyber-hijacked. Join us this week on The Corbett Report as we explore the strange details surrounding the untimely death of Michael Hastings.

Yep, and State Street seems to always make it a trio.

This was an excellent article, I didn’t want it to end! succinctly and perfectly put…

“when we peel back the layers of propaganda from the past three years, we find that the remarkable events of the scamdemic have absolutely nothing whatsoever to do with a virus. We are instead witnessing a changeover in the monetary and economic system that was conceived, proposed and then implemented by (you guessed it!) BlackRock.”

Can’t wait for part 3…’Aladdin designed to eliminate humans from the equation’

Roger James Hamilton is not a man I trust, but the 2 min vid he narrated on ‘Aladdin’ is most interesting.

https://www.youtube.com/watch?v=WTF6MmpJmPs

And so it goes on ….

BlackRock’s Financial Markets Advisory will consult Ministry of Economy for UKRAINE on creation of a roadmap for implementation of an investment platform.

https://www.kmu.gov.ua/en/news/ministerstvo-ekonomiki-ukrayini-pidpisalo-memorandum-iz-najbilshoyu-investkompaniyeyu-svitu

Enquiring minds are pondering whether the trevails of SBF and FTX will cause a problem with this agreement.

well, if one just look at those screenshots, vanguard seems to be worse, is also always there and has even more shares than blackrock…. sooooo, what can i make of it?

naim ~ ” vanguard seems to be worse, is also always there and has even more shares than blackrock…. sooooo, what can i make of it?”

Check out who’s the largest shareholder of Vanguard and all becomes clear 😉

Thank you for explaining the Blackstone/Blackrock distinction. Great example of competing factions promoting the same goals. So looking forward to the next two parts.

Isn’t it interesting how significant the ‘BlackRock’ seems to be to the ideology of the global ‘cult’ as I like to term them…Another significant Black Stone is a rock, set into the eastern corner of the Kaaba, the ancient building in the centre of the Grand Mosque in Mecca, Saudi Arabia. Another is to be found in the UN Meditation/Prayer room, a 6-ton iron ore stone altar as a sign of permanence in a world of change…or indeed a BlackRock.

It wouldn’t surprise me to find other examples if I had the time or inclination to look…significant? Maybe…

from zerohedge wed am, programable dollars trial in the big apple:

https://www.zerohedge.com/markets/here-come-programmable-dollars-new-york-fed-and-12-banking-giants-launch-digital-dollar

Engdahl has good article on Blackrock:

https://www.globalresearch.ca/how-blackrock-larry-fink-created-global-energy-crisis/5799286

Thanks for this article. I keep seeing the name tossed around but had little idea who they actually are. Looking forward to the other parts.

pleeeeeeease can we have a video / documentary on this.

Lol…. I like audio stuff too but you must admit that reading gives you the information faster and with better retention. 🙂

I always hoped Mr Corbett would do a book one day but he could probably just edit all his transcripts into a massive tome

You got your wish!

Thanks for the fun soundboard link James 🙂 I think someone should add “screw your freedom!” to the list and also someone should do a voice over clip with a video sequence from terminator with his cyborg face showing as he says “Screw your freedom!”.

Shared on my blog. When I listen to this I just wonder , how long, oh Lord?

I’d just like to mention something that I’m sure none of the viewers know about James’ video production of How Black Rock Conquered The World (which, as always, is another brilliantly researched and presented documentary as only James can do.) As his proud music teacher, I want to openly say that ALL of the music in the video was composed, mixed and produced by James himself. I knew that James wouldn’t mention it, but without a doubt it deserves mention. This is a first for him.

Not many people are aware of how much blood, sweat and tears go into producing music for a video so I’ll just say this: he put serious labor into making the music work. So if you decide to watch the video, also keep an ear open for the subtle background music. I’m sure the music production doubled the amount of time it took to make this video happen. Congrats, James!

BUMP

Awesome!! I thought the music was quite effective. Bravo James!!

And a round of applause for Broc as well. This is a masterpiece!

Another fact to be amazed and humbled by.

On Tuesday/Wednesday September 18/19, 2023

James Corbett released the 59 minute VIDEO…

Episode 449 – How BlackRock Conquered the World

https://www.corbettreport.com/blackrock/

James Corbett excels at “telling a story”! It is a CorbettReport trademark.

I’ll have to watch this video again, because on my first watch I became incredibly impressed by the visuals, their timing, the bold font, and how everything meshed to help convey concepts.

Typically, most people find “finance stuff” dry, kind of like eating sawdust for dinner.

The VIDEO “How BlackRock Conquered the World” is an extremely important story, well told.

This important message bears repeating, and I am so glad that Corbett pushed the aspect of dissemination.

Everyone is engulfed by the system, and Corbett’s Blackrock narrative gives insight into that.

Coincidently, the VIDEO “How BlackRock Conquered the World” is very timely.

For example:

Repeatedly, during Robert F Kennedy Jr’s Presidential campaign trail, he brings up Blackrock.

QUEUED video at 32:13 – Breakfast Club Power 105.1 FM – RFK, Jr interview

Robert F. Kennedy Jr. Talks 2024 Presidential Run, Reparations, Covid Vaccine, Science + More

https://www.youtube.com/watch?v=qHplDaAR_LM&t=1933s

Blackrock buying homes in America

RFK, Jr. talks about Blackrock and its sisters buying up homes in America. All the while, rents shot to the roof and “inventory” was low for new home buyers.

In 2022, CBS Texas ran this headline:

Nearly one out of every three homes sold in DFW in August was bought by an investor

A Real Estate Data Crunching Firm confirms…

At least one out of every 5 homes in America is owned by an investor

https://www.corbettreport.com/september-open-thread-2023/#comment-155542

VIDEO published on Sept 19, 2023 – NTD channel

RFK Jr. Talks About ‘Real Reason’ for America’s Housing Problems, Calls Out ‘3 Giant Corporations’

(16 minutes)

https://www.youtube.com/watch?v=u3TVUgPJ3nA

DESCRIPTION

When speaking at a Hispanic Heritage Month event at Wilshire Ebell Theatre in Los Angeles, California, on Sept. 15, Democratic presidential candidate Robert F. Kennedy Jr. talked about the serious housing issues in the United States. He blamed “three giant corporations” (BlackRock, State Street and Vanguard) for high home prices and homeless problems in San Francisco and other places across the nation.

Robert F Kennedy, Jr QUOTE

“All of us know kids living with parents who should have left. If we stay on this track, 60% of private homes will be owned by Blackrock, State Street and Vanguard.

Blackrock CEO Larry Fink is orchestrating the Great Reset.

You will own nothing and you will be happy.”

He pointed to a book by Matthew Desmond that argues homelessness is caused by unaffordable housing, not drug addiction.

Here is the full 3 hour 17 minute event…

(Fun music at beginning of video)

Hispanic Heritage Event Livestream With Robert F. Kennedy Jr.

https://www.youtube.com/watch?v=9fTag-oq_ho

An evening with Robert F. Kennedy Jr. to celebrate Hispanic Heritage Month at the Wilshire Ebell Theatre in Los Angeles, CA.

Tuesday August 1, 2023 – MoneyMorning – By Garrett Baldwin

Here’s Why BlackRock (or State Street or Vanguard) Will Be Your Kids’ Landlord

https://moneymorning.com/2023/08/01/heres-why-blackrock-or-state-street-or-vanguard-will-be-your-kids-landlord/

EXCERPTS

If you need further proof that our entire system is designed to make bankers wealthier… and rip every dollar from your hand… consider this…

“Institutional investors may control 40% of U.S. single-family rental homes by 2030, according to MetLife Investment Management.”

If this figure holds, it’s game over for Millennials and Generation Z.

As they say: “You’ll own nothing and be happy.”

Institutional players like BlackRock, State Street, and Vanguard on the other hand…

Well, they’ll own everything and be happy.

And that will happen because our system all but assures that wildly skewed outcome.

Here’s how…

— Regular Americans Will Be Lucky to Get the Crumbs —

Over the last year – June, October, March – we experienced massive equity market selloffs. Mom and Pop got wiped out, while the whales of Wall Street came out in force to buy, buy, buy. That selloff fostered a dramatic uptick in institutional buying…

…That’s because Wall Street, looking for “new worlds to conquer,” is increasingly turning its attention to the other things that matter: Food, housing, and energy.

And housing will be a big business because of the cash flow. This is the single biggest expenditure of the American family.

These institutions don’t want families building equity. They want to siphon that equity off for themselves….

August 1, 2022

EXCERPT

Institutions have committed more than $60 billion to buying single-family homes over the past year, according to various corporate announcements and news articles.

Recent research by MetLife Investment Management (MIM) estimated that institutions own some 700,000 single-family rentals in 2022, about 5 percent of the 14 million SFRs nationally.

MIM forecasts that by 2030, institutions will increase SFR holdings to 7.6 million homes, more than 40 percent of all SFRs.

Institutional acquisitions of SFRs in communities of 50 or more units soared in 2021 to $2.5 billion, according to Yardi Matrix.

https://www.prnewswire.com/news-releases/institutional-investment-in-single-family-rentals-is-on-the-rise-reports-yardi-matrix-301596511.html

At least one out of every 5 homes in America is owned by an investor

QUEUED at 6:32 – Reventure Consulting

“Wall Street CANCELING CONTRACTS on Houses (65% Crash in Las Vegas)”

https://www.youtube.com/watch?v=-gzF3qafpC4&t=392s

According to the US Census Bureau around 20 million houses in America are investor owned.

According to Core Logic, it’s closer to 27 million.

So that’s anywhere between one quarter and 1/5th of all homes in America are owned by an investor.

We truly appreciate the first Black Rock report, but it seems the comment’s sections could be structured better with the utilization of a touch of common sense. Why would James think a new comments section, tied to a newly released post, would be confusing? What’s the less confusing aspect to connecting to an old comments section as opposed to a more recent comment section connected to a more recent post?

Very odd.

Thanks!

The original post was an editorial (aka newsletter). The video documentary is what’s new. I’m guessing he wants to highlight that his written report came first. Plus it’s all the same content just being consumed through different medium. It actually makes sense to keep the comments related to the exact same content preserved in one place.

BlackRock vs James Corbett.

BlackRock: Assets – 66.6 Trillion under management.

James Corbett: Current assets – 4 guitars, electric piano, Kodomosan rock band, impressive reference library, 2 Mac computers, studio gear/software/lighting equipment, loving wife, 2 adoring children, brilliant editor, thousands of enthusiastic supportive subscribers. Among his numerous fans – many married CR cheerleader couples dressing the entire family in Corbett Report T-shirts. Kids lobbying for red capes and blue leotards to complete the ensemble. Insisting on wearing them to bed.

BlackRock History: As manager of First Boston Investment Bank, Larry Fink, in 1986, manages to lose 100 million in a single quarter by guessing wrong on interest rates. Blackstone co-founders, impressed with Flint’s reckless risk taking, hands him 5 million to invest. By 1992, Fink’s portfolio worth 17 billion. Fink and Schwatzman deciding to create a spinoff with Black in the title. Fink rejecting “BlackPebble”. Small think. Decides on BlackRock after rejecting BlackHole. Fink later buying Schwartzman’s share for 230 million. BlackRock goes public in 1999 at $14 a share. Using Aladdin’s analytic risk management proprietary software, BlackRock later acquires State Street financial services and bank holding company, Merrill Lynch Life Agency insurance, and Quellos hedge fund to complete the trifecta in 2007. Now managing assets more than 1 trillion.

Cue financial crisis 2007/8. Subsequent to the Lyman Brothers implosion and 2008 sub-prime meltdown, who better to pick up the pieces than the one responsible for creating the toxic sub-prime mortgage industry in the first place!? Mr. CMO (Collateralized Mortgage Obligation) himself. The Fink. When dust settles – BlackRock looms large through the haze. Bloomberg announces: “In Fink We Trust: BlackRock Is Now Fourth Branch of Government”.

James Corbett History: Subsequent to completing a B.A in English from University of Calgary, James granted a scholarship to Trinity College in Dublin earning a Master of Philosophy in Anglo/Irish literature. Circling the literary wagons, contemplating a permanent career path, James decides to teach English in Japan. After relocating to an apartment with internet access, James encounters whacky stories about a 911 conspiracy. Which, upon further investigation, don’t seem so whacky. After all. While supporting himself as an English teacher, working from his cramped cockroach invested quarters in his spare time, conspiratorial curiosity leads to some startling revelations. Sense of blatant injustice awakened; James creates the Corbett Report website in 2007. All by himself. Developing skills as an online sleuth he begins inviting various knowledgeable guests to discuss controversial topics avoided by the mendacious corporate media. Waving analytic flashlight to and fro, down the conspiratorial Rabbit Hole, illuminating one dark n’dirty Deep State ditch after another, finally devoting full time to pulling back the curtain on the New World Order Great Reset Covid conniving cabal of psychopathic sophists.

James Corbett. The Cherry Blossom Kid. Independent journalist hors pair (https://www.corbettreport.com/about/). The Wizard of Odds. All in against the devious Fink shysters of this world. Thank you, James. You’re the cream in my kōhii.

I wonder if OneKnightErrant is related in any way to Keith Knight of Don’t Tread on Anyone?

On the topic ESG, this podcast by James Lindsay is highly instructive and expands on what James said in the video:

Sustainability: The Tyranny of the 21st Century

https://www.youtube.com/watch?v=MpMebedQjPM

Wonderful work. We are surrounded by the same ecofascist agenda. It has a great ideological affinity with the Nazis. It’s not a new thing.

“This striving toward connectedness with the totality of life, with nature itself, a nature into which we are born, this is the deepest meaning and the true essence of National Socialist thought.”

Ernst Lehmann, 1934

https://youtu.be/Heq87NO6udc?si=ZSwJDioSCaULGNiR&t=424 : “With the characteristic that in addition, the main shareholder of BlackRock, is Vanguard, and the main shareholder of Vanguard, is BlackRock.” (activate English subtitles)

On most Brokerage accounts, the Brokerage offers a research bar for individual Wall Street stocks.

When you click on a specific stock, there will be a pile of information, graphs, data boxes from rating services, and the like. The Brokerage subscribes to different rating services. (e.g. Swchab, MarketEdge, The Economist Intel Unit)

The MSCI ESG Rating box is typically among the other boxes of rating services.

The MSCI box will have each a rating on that stock for Environment, for Social, and for Governance. And just like your first grade teacher, each one of those three will be graded as either “Laggard” or “Average” or “Leader.”

Amazon AMZN

Environment – Average – 6.3 out of 10

Social – Average – 4 out of 10

Governance – Average – 4.8 out of 10

Alphabet Inc. A (GOOGL)

Environment – Leader – 7.5 out of 10

Social – Average – 4.6 out of 10

Governance – Average – 2.9 out of 10

Blackrock Inc (BLK)

Environment – Leader – 10 out of 10 [Bonus points for eugenical, tyrannical enslavement.]

Social – Average – 4.9 out of 10

Governance – Average – 5.5 out of 10

Endeavour Silver Co (EXK)

Environment – Laggard – 2.6 out of 10

Social – Average – 6.2 out of 10

Governance – Average – 6.4 out of 10

IMAGE infographic – MSCI ESG Rating

Inside ESG Ratings: How Companies are Scored

https://www.visualcapitalist.com/sp/inside-esg-ratings-how-companies-are-scored/

Don’t be labeled a “Laggard”, don’t be “Average”, be a “Leader”…

…and have your vomit bucket ready for the 4 minute video.

What is an MSCI ESG Rating?

https://www.msci.com/our-solutions/esg-investing/esg-ratings

Time to start relocating those investment funds away from globalist Blackrock associates and into local businesses with integrity.

I am pretty condident we can not win at their game. They hold all the cards. Hell, they introduce more cards as they need them.

Outstanding doco, and pitched really well to engage people with a range of attention spans, shall we say. I’m sending it out to lots of people.

Less we not forget Trump’s giving control of much of the “bailouts money to BlackRock: https://www.bnnbloomberg.ca/blackrock-becomes-key-player-in-crisis-response-for-trump-and-the-fed-1.1423107

Gotta love how well-represented the Bank of Canada is…

Thanks for this, phenomenal work!

Hey James, That was pretty amazing. Like really amazing. About 3/4 of the way through (the first time) I started to wonder if these weirdos had anything to do with normal people’s investments going into the toilet. One friend said his Telus stock had fallen by 51%. I would imagine that’s a fairly blue chip item, so I was surprised. Anyone?

Michelle Makori of Kitco News

Is Blackrock looking to control the Bitcoin ecosystem

A minute

https://www.youtube.com/shorts/K0AiKofsIhI

Illustrated by Mike “show me the money” Johnson.

UPDATE August 2024 – ESG…

August 21 – Bloomberg

BlackRock Cuts Backing for Climate, Social Shareholder Proposals

https://web.archive.org/web/20240822091002/https://finance.yahoo.com/news/blackrock-cuts-backing-climate-social-130023310.html

FULL Article

(Bloomberg) — BlackRock Inc. reduced its support for shareholder proposals on environmental and social issues for a third straight year, arguing that many of the efforts lacked merit and harmed long-term financial interests while doing little to improve companies.

The world’s biggest asset manager backed 4% of 493 such proposals in the 12 months through June, New York-based BlackRock said in a report Wednesday. That’s down from 7% a year earlier and more than 20% in the same period through mid-2022.

The firm, which said in January that its stewardship team was focused on the financial health of corporations, increased its support for resolutions on corporate governance — the “G” in ESG investing. BlackRock supported 21% of such proposals in the period, up from 11% a year earlier, according to the report.

BlackRock said shareholder proposals overall face considerable opposition because they’re of “poor quality or unconnected to how a company delivers long-term shareholder value.”

Many proposals are filed by advocacy organizations targeting US companies regardless of the specifics, BlackRock said.

“Investors found the majority of these proposals to be overly prescriptive, lacking economic merit, or asking companies to address material risks they are already managing,” Joud Abdel Majeid, global head of investment stewardship, wrote in the report, referring to social and environmental proposals.

BlackRock, which managed $10.6 trillion of assets at midyear, is a top-five shareholder in the vast majority of S&P 500 companies and has drawn intense scrutiny from US investors and politicians for how it votes and engages with corporations on hot-button ESG issues. Overall, the firm supported companies’ management on about 88% of total proposals globally.

Republicans have sharply criticized BlackRock’s advocacy of ESG or sustainable investing as harming the economies of states with significant energy industries, such as Texas and West Virginia. The backlash led some state pensions and treasurers, as well as a Texas fund for public schools, to yank capital from the firm.

BlackRock has long maintained that it does not boycott fossil fuels, and the company said earlier this year that it managed more than $300 billion in global energy investments.

Money managers across the industry reduced their support for environmental and social resolutions in the past year, including those pushed by anti-ESG campaigns. Average support for the resolutions fell to 16% in the most recent proxy year from 19% in the prior year, according to Morningstar Inc.