Bitcoin $10,000? Already? It seems like just a few months ago that I was writing about the price of one bitcoin surpassing the price of one ounce of gold.

Oh wait. I was. “Bitcoin Over Gold: What Does It Mean?” was written in March 2017. Fast forward 8 months and here we are with the price of one bitcoin topping $10,000. $10,138.06 as I type these very words, to be precise.

But what’s in a number? By the time you read these words the price could very well have leapt to $15,000 and it could just as easily have plunged to $1,000. (If you’re curious you can check the current price here.)

Don’t believe me? Then you clearly haven’t been watching the bitcoin price at any point over the past 5 years. Exhilarating spikes and dizzying plunges happen all the time. When it comes to crypto trading, volatility is the name of the game.

This, of course, is manna from heaven for the financial press, which can now generate a seemingly never-ending stream of “Oh My God! Bitcoin Is Exploding!” and “Oh My God! It’s A Crypto Bloodbath!” stories, just swapping out one story for the other every day or two (sometimes multiple times a day). But all of these stories are a sham.

Find out the truth about “bitcoin $10,000” and what it really means in this week’s edition of The Corbett Report Subscriber editorial.

For full access to the subscriber newsletter, and to support this website, please become a member.

For free access to this editorial, please CLICK HERE.

|

The Corbett Report Subscriber

|

vol 7 issue 43 (December 2, 2017)

|

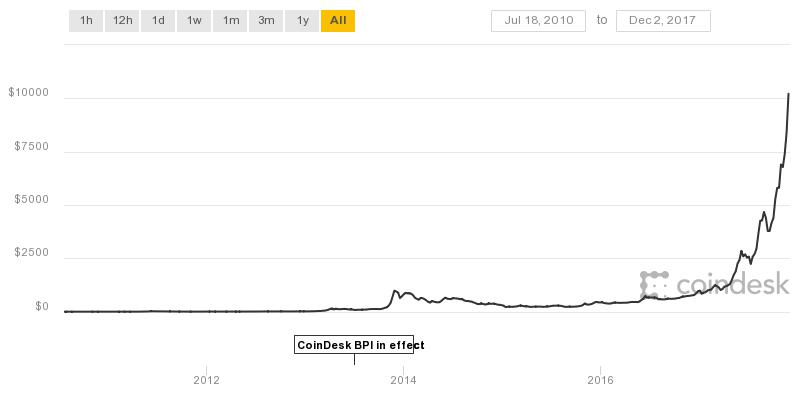

by James Corbett Bitcoin $10,000? Already? It seems like just a few months ago that I was writing about the price of one bitcoin surpassing the price of one ounce of gold. Oh wait. I was. “Bitcoin Over Gold: What Does It Mean?” was written in March 2017. Fast forward 8 months and here we are with the price of one bitcoin topping $10,000. $10,138.06 as I type these very words, to be precise. But what’s in a number? By the time you read these words the price could very well have leapt to $15,000 and it could just as easily have plunged to $1,000. (If you’re curious you can check the current price here.) Don’t believe me? Then you clearly haven’t been watching the bitcoin price at any point over the past 5 years. Exhilarating spikes and dizzying plunges happen all the time. When it comes to crypto trading, volatility is the name of the game. This, of course, is manna from heaven for the financial press, which can now generate a seemingly never-ending stream of “Oh My God! Bitcoin Is Exploding!” and “Oh My God! It’s A Crypto Bloodbath!” stories, just swapping out one story for the other every day or two (sometimes multiple times a day). But all of these stories are a sham. Case in point: ZeroHedge’s story from earlier this week, “Crypto Carnage Continues As The Fed Warns Digital Currencies Could ‘Pose Serious Financial Stability Issues.'” They manage to invoke the “bloodbath” description in the very first sentence to discuss the “clawback” from bitcoin’s flirtation with $11,000 earlier in the week. As you may have noticed, bitcoin plunged back down to $9,000 on Thursday morning, prompting traders to claim (for the 198th time, in case you’re keeping track) that the end was nigh for this silly experiment in internet play money. To illustrate their point they invoked this chart:  Complete with plunging red arrows to help the reader understand what downward movement on a chart looks like! Scary looking, I suppose. Until you put it in context. When you look at the full history of the bitcoin price chart, do you see the tiny blip that was being hailed as a “bloodbath?” Neither do I. In fact, the article gets even better. It goes on to explain that “there is no immediate catalyst” for this “carnage” and then includes a lengthy section on how the price could hit $20,000 by the end of the year. That’s quite a lot of base-covering for a site claiming to have zero hedge. Now, don’t get me wrong: this isn’t meant as a hit piece on ZeroHedge. If anything, ZH is one of the few sites that is willing to print a range of stories on bitcoin, from the absurdly bullish to the absurdly bearish and everything in between, so it’s not a bad place to hear from both the bitcoin boosters and the crypto critics. But this example article does demonstrate some very important things about the bitcoin phenomenon:

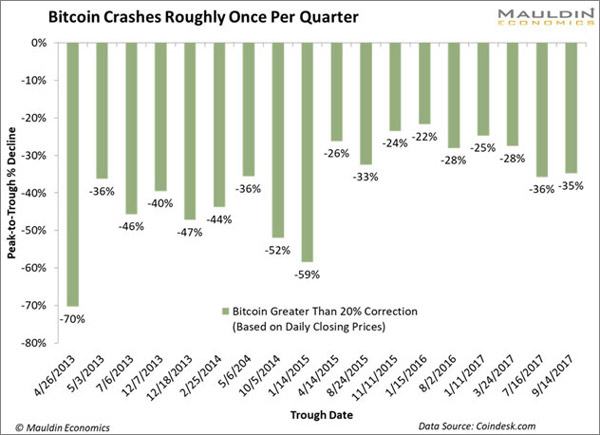

Here’s the fact of the matter: bitcoin is in a speculative bubble right now. The price is being driven up by intense interest from people who are just hearing of cryptocurrencies for the first time, people who have been on the sidelines but can’t bear to feel they’re missing out on the opportunity of a lifetime, and, more importantly, banksters and fraudsters. It is the latter two categories of bubble blowers that, unsurprisingly, have a lot of bitcoin watchers (even some dyed-in-the-wool bitcoin die hards) wary. The banksters are finding their way into the market in the usual way: derivatives. Why waste your time buying and selling bitcoin directly like a regular, day-trading chump when you can be a high-falutin’ 21st century Gordon Gekko trading bitcoin derivatives? Well, never fear! The good folks at the CME and CBOE Futures Exchanges are going to be launching bitcoin futures trading later this month in a move that was just approved by the CFTC. And then there are the fraudsters. If you haven’t heard of the tethercoin/Bitfinex disaster-in-waiting, there are any number of resources online to get you up to speed. Suffice it to say, Mt. Gox was not the only super shady exchange scam in bitcoin history and it certainly won’t be the last. Combine all of this with the inevitable (and not undeserved) Tulipmania comparisons and the stage seems perfectly set for yet another installment of the quarterly bitcoin crash. But every quarterly crash in the past has been followed by exponential growth that has brought bitcoin to new heights. Will this time be any different? Are we about to see another +20% “correction” and another period of exponential growth? Or the bursting of the bubble altogether? Or no correction at all on the way to $20,000? Well, here’s my controversial answer: It doesn’t matter. That’s right, it doesn’t matter. If you’re investing in bitcoin because you want to make some quick bucks, you’re an idiot. Now to be sure, there are a lot of millionaire idiots out there, and if all you want in life is lots of zeroes in your bank account, then have fun. Maybe you’ll buy low, sell high, cash out with a lot of Federal Reserve Notes and live “happily” ever after (by which I mean “until the Federal Reserve Notes become toilet paper”). Or maybe you’ll buy in at the top and lose everything. Again: it doesn’t matter. Why not? It’s like saying that the story of the internet revolution was the story of what happened to this or that trader during the dot-com bubble. Yes, maybe Trader A made a fortune and Trader B lost it all and Trader C broke even, but on the world-historical scale, it doesn’t matter. What matters is that the world has transitioned from a pre-World Wide Web economy to a World Wide Web economy, and we are still dealing with the ramifications of that. The first bubble of speculative investment surrounding that transition and its inevitable popping is now a footnote in that history, just as the daily price movement of bitcoin (measured in fiat dollars) will be a footnote in future history. The main story is the transition from the pre-cryptocurrency economy to a cryptocurrency economy. Given the lingering and still unresolved question of the scaling debate and the many forks and splits it has caused so far, it is by no means certain that bitcoin will even survive at all, or that the crypto that emerges with the “bitcoin” name will bear any resemblance whatsoever to the central bank-less, borderless, instantaneous and practically-free medium of exchange that was originally promised to bitcoin’s (mostly libertarian) early user base. Again: it doesn’t matter. What matters is that the cryptocurrency idea will survive this period, whatever happens with the bitcoin bubble, just as the World Wide Web didn’t go away when the dot-com bubble burst. Now you might love that fact or you might hate that fact, but it’s a fact. As with everything else, it’s a question of what we do with this fact. Can a cryptocurrency that lives up to the “pirate money” ideal be created, or is the idea destined to be neutered, co-opted and wrestled back into the service of the banksters? Now that is the question that matters. But that is a question for another day. In the meantime, better prepare some popcorn. This is going to be one hell of a ride. |

Recommended Reading and Viewing

Recommended ReadingSites really are watching your every move – Ars Technica Recommended ListeningSelf-Ownership (audiobook/PDF/paperback) Recommended ViewingThe truth about the Videos Trump Retweeted from Britain First Just For FunThe Duffel Blog military satire site featuring Saudi Arabia beheads first female robot citizen + Army to rename slave cables to freedom cables + Turkey pardoned by Trump had multiple contacts with Russian officials etc… |

[supsystic-price-table id=59]

The thing with ZH is that they cover every possible outcome with dozens of articles, so whatever happens they called it. However, I don’t think that sets them apart much from most other economy and fraud related websites.

The thing with bitcoin is that people assume it’+s very safe, because in the event the internet goes down we may assume a lot would go down with it, leading to an apocalyptic setting. In that world, precious metals wouldn’t be worth their weight in bullets, alcohol or corn.

There is no reasoning for FIAT currency, they always go to zero. In a post apocalyptic setting, it could happen that some sort of “old” currency is used instead of bartering, though. Bottle caps could be used too, anything that is ostensibly scarce and difficult to forge or copy.

The good thing about gold is that it has a rather high price per kilo. If push came to show, I could see myself tucking that 0.5 kilo bar in my pocket and heading for the hills. Don’t know what would I be doing with 20-30 kilos of silver, though.

Low premium coins would work as well. I find the wafer thing really is fit only for a SHTF scenario in which lead would be the other precious metal.

Money is a medium of exchange and typically something with a stable value to use in exchange. Bitcoin apparently does not have a stable value and so in a traditional monetary sense it would not be useful as money. Looks like cryptocurrency development is still evolving.

Note the distinction between money and currency. The two have some shared properties – fungibility, divisibility, durability, portability. There is also scarcity, which usually does not fly with FIAT and it used not to fly with gold coins either, since typically greedy governments will find ways to dilute the currency/money supply. The credit created-out-of-nothing method we’re witnessing this iteration is an especially creative approach.

Bitcoin, unless there is something evil in the underbelly of the beast, does meet the scarcity condition and as such is better than any other FIAT trust based currency. To some extent, bitcoin is based on trust too, but the trust lies on the person/people/A.I. whom/which created it instead of a delusional figure of authority. The whole good Samaritan thing does not really make me trust the whole platform, but that’s just me talking.

We could maybe use bitcoin/crypto currency interchangeably, but I’m not sure if every crypto is meant to be scarce in supply, i.e. fixed in availability to a certain amount as defined by the protocol. Probably an argument could be made that a certain amount of currency could be added to the pool with each new user thus mellowing competitiveness a bit, but that would be very tough to enforce and what’s wrong with competition anyway.

Money, however, in addition to above mentioned properties, also has to be a store of value. Precious metals have been vetted by history in this regard, acting like a thread reaching ages back, connecting us to the formative era of markets and money, with much of the same material being still in use today.

(I’m absolutely not a gold bug, but where credit is due it ought to be given)

Good point about the “limited supply” and scarcity and availability.

James Corbett says:

…It doesn’t matter. That’s right, it doesn’t matter… … What matters is that the world has transitioned from a pre-World Wide Web economy to a World Wide Web economy, and we are still dealing with the ramifications of that…

…What matters is that the cryptocurrency idea will survive this period, whatever happens with the bitcoin bubble, just as the World Wide Web didn’t go away when the dot-com bubble burst. Now you might love that fact or you might hate that fact, but it’s a fact…

…Can a cryptocurrency that lives up to the “pirate money” ideal be created, or is the idea destined to be neutered, co-opted and wrestled back into the service of the banksters?

Now that is the question that matters….

So true.

I don’t know.

Listen to Andreas Antonopoulos

https://www.youtube.com/watch?v=wSRN8PUhHX0

Very interesting viewpoints.

Here is a computer engineer, “the bitcoin guy”, looking at societal and organizational structures which don’t align with new technologies.

Around the 8 minute mark, he talks about how sociopaths tend to rise to the top of organizations.

James Corbett gave away FREE to CorbettReport Members “$109.00” of BitCoin.

Back in late February 2017, James Corbett gave away free to any Corbetteer requesting it, 0.01 Bitcoin which is now (as I type) worth around $109.

The give-away occurred during this episode Who Coined the Term “Useless Eaters”? – Questions For Corbett https://www.corbettreport.com/who-coined-the-term-useless-eaters-questions-for-corbett-034/

If you read the comment section, a lot of folks participated in that opportunity.

Here is the YouTube video queued to where James talks about Bitcoin. Around the 21 minute mark is the “give-away”.

https://www.youtube.com/watch?v=6NuLWCHvkc8&feature=youtu.be&t=16m32s

I’ll be honest. I like to gamble on occasion, but I realize that I can lose money when I gamble. I don’t have a lot of money. Sometimes, though I will play with some.

So recently, just about at WTI Crude’s peak, I bet that it would decline with an ETF “OILD”. Having sold that on a day it rapidly declined, I then later bought…

CME (which Corbett mentions in his article above)

https://finance.yahoo.com/quote/CME/?p=CME

Bitcoin Investment Trust (GBTC)

https://finance.yahoo.com/quote/GBTC?p=GBTC

…and because silver has gone down to a very low level…

https://tradingeconomics.com/commodity/silver

I gambled strongly with a 3x ETF USLV that silver will probably eventually go up.

https://finance.yahoo.com/quote/USLV?p=USLV

Make no doubt about it. It is gambling. The markets are a rigged game. I know I might lose some money.

Maybe I’m an idiot. It doesn’t matter.

The first part of this video, the speaker makes the point that much of the World has not yet participated in crypto-currencies like Bitcoin.

The man who called bitcoin $10K now sees this for the cryptocurrency Bitcoin 6x by end of 2018!

https://www.youtube.com/watch?v=Br6-W3Dlob0

Original video here…

https://finance.yahoo.com/video/man-called-bitcoin-10k-now-222700433.html

For an incite-full presentation on Bitcoin listen to some of Andreas Antonopoulos’ talks.

https://www.youtube.com/watch?v=MxIrc1rxhyI

https://www.youtube.com/watch?v=wSRN8PUhHX0

https://www.youtube.com/watch?v=l1si5ZWLgy0

On Corbett Report’s “Just For Fun”…

the humor is so good, it should be illegal.

https://www.duffelblog.com/

Don’t worry. I’m sure they’re working on that. Satire is being called “fake news” these days, so it may be censored at any rate.

Glad to see you back, Pablo. You are of course right about “Corbetteer.” It’s a funny-sounding catchphrase, but this work is not about me it’s about the info, so I will be retiring my use of it.

Pablito dice: …I’m not a Corbetteer, because I adore to be fully independent and being myself.

Corbettito dice: …You are of course right about “Corbetteer.” It’s a funny-sounding catchphrase, but this work is not about me it’s about the info, so I will be retiring my use of it.

There is no such thing as FIAT money, only FIAT currency. But, to leave semantics aside, as far as I’m allowed to speak in Pablo’s name, I don’t think he considers those gains as “earned” but as a reward for putting his faith or trust into this technology.

Considering these price surges are payed by people who like to join the party late (i.e. schmucks) I personally have no moral qualms over it. Financial speculation at its best, nothing more, nothing less.

As far as betting goes, we should agree that betting is at the centre of our lives. We bet all the time, be it the school we’ll be attending, the woman we’ll be dating, jobs we’ll be doing, that used car we’ll be buying… it rarely boils down to one choice so we have to assess and, for all intents and purposes, make a bet on the path which seems most rewarding. It’s always a gamble and most of the times it feels as if the dices are loaded.

It is one of those terms that has been coopted. I wrote a bit more on that above, here https://www.corbettreport.com/bitcoin-10000-what-does-it-mean/comment-page-1/#comment-46136

Max Keiser used that term quite profusely in his podcast to describe not jerks but losers, I guess. He’s also the one who has been pushing a heluva lot for bitcoin over the years, he “announced” it was going to hit 10k about 3-4 years ago.

I don’t see it like that, losers and winners. Just lucky and not so lucky. And those who get some insider information and those who trust their brokers. Losers wouldn’t be those who bet, but those who try to bet their way out of a hole.

What I meant with my statement is that there’s a certain class of people who enter markets once markets hit a certain state of maturity. These people probably have enough funds to purchase high and are basically playing a game of diminishing returns. Of course, there is no saying where will bitcoin cap, it may just as well go to 100k this time next year so to that extent it is difficult to appraise what does “late entry” or “buy high” really mean nor how is it to be timed. What I’m willing to guesstimate is that many of these investors purchase at 9k and then rush to sell if the commodity hits 5 or 6k just a few weeks later only to bounce up again. The same game, according to Keiser, has been going on for a long long time in the traditional financial markets.

What I find most interesting is that without the people buying into the fad the price volatility would be much less. Now, one may state that I’m full of shit because you have a bunch of people here trying to get out of global banking grid and switch over to an alternative system. Well, I remember as a kid what it meant to have a currency with extremely volatile exchange rate. Albeit, that currency at the time was just going down and adding zeros, but people had to resort to all sort of shenanigans to preserve some of their purchasing power.

I wouldn’t label these “late” investors as enlightened, but that’s just how I see it.

What you guys say about Bitcoin and gambling is true to a certain degree.

When a person walks into a casino, they are aware that there are winners and losers. Las Vegas was built on losers.

When a person plays the commodities or stock-exchange game, people are aware that there are winners and losers. And they should be aware that it is a rigged game.

Any retailer buys low and sells high. The wholesalers and jobbers do the same. Typically, the retail mark-up is keystone (50%), sometimes 30-40%. Sometimes a retailer buys a bunch of inventory which doesn’t sell…he takes a hit and tries to liquidate it. Sometimes, a retailer buys a “hot selling item” driven by a fad or demand.

Supply lines/demand and competition play a big role in how retailers price their product.

The same is true for Bitcoin. There is a limited amount.

Like a retailer, an individual could buy Bitcoin in the hopes of reselling it in the future at a higher price because that person predicts a higher demand.

People do not enter a business enterprise to sell things below the cost. Every individual in the world is involved in some sort of commerce activity. Employees sell their time/service for something. The employer hopes to “resell” the value of that service at a higher mark-up.

The whole shebang of life has risks.

The allure of gold must be genetic. I’m sure there is something on the chemical level attracting us to it, like a fly would be attracted to poo. That sure puts all the treason, murder, theft etc. committed over gold in a different perspective, doens’t it.

Anyway, I agree with this general feeling I get from your post, that one can’t trust the unknown, unless blindly. I personally see these bitcoin facts as a huge glaring problem which people appear to be overlook en masse, but maybe people are simply struck by bitcoin fever. It could be argued that bitocin is a work of a good Samaritan, however without knowing their identity we can’t examine their motivation.

I sure hope I haven’t insulted anyone by using that word, it wasn’t my intention. I don’t see people who bet in general as anything but people. When this habit turns into a problem, I don’t see that any different than an alcoholic mooching his moonshine or a tweaker with bloodshot eyes snorting or in any other way ingesting whatever he can get hold of; this modern way of life creates a lot of problems and the society at large is unable to handle these issues efficiently.

Your aunt was definitively not a schmuck. I do think the higher ups in the pyramidal structure of power don’t consider those below them with too much respect; the only proper feeling the ruler ought to have before his subjugates is fear.

I see your points. There is a substantial gap between winning and earning, which helps explain the rather high percentage of lottery winners who managed to get bankrupt really quickly.

I wouldn’t consider a broken marriage as a bet lost, either. There are many fundamental reasons as to why marriages fail, lack of understanding and unwillingness to adapt probably being prime reasons. All I wanted to say there is that there are many situations in life where we can’t choose the more appropriate path by taking facts and parameters into account. So we have to place a bet on some aspects, hoping that they lead us to success, while there is no implication that there even is a winning or a losing bet. Life seldom offers a 50/50 split and choosing the right woman definitively does not fall into that category; it’s more akin to some of the stunts pulled by Indiana Jones while he’s on his way through any given mountain of doom, his path beset on all sides by rusty traps and venomous snakes.

Finally, I’ll agree with you that investment or capitalizing on an investment does not equate prosperity. Only good old fashioned work may lead to prosperity, however even that doesn’t hold water in these modern times anymore.

john.o,

I too like the moniker.

It is a descriptive which holds certain ideas of freedom and individuality.

I definitely understand why James Corbett doesn’t really want the term. He is not in this for glory, but for a better world.

Pablo, I figured you were pretty busy with things going on in your life. That is wonderful news about the Bitcoin windfall. This is a fine example of how increased awareness helps one prosper.

Give your Cubana Guapita another squeeze…it’s “good luck”.

Dec 5th, 2017 – Bloomberg

Making the Case for Bitcoin $400,000 (90 second video)

https://www.bloomberg.com/news/videos/2017-12-05/making-the-case-for-bitcoin-400-000-video

GRAPHIC – “Bitcoin price” and “Google search” correlation

https://ei.marketwatch.com/Multimedia/2017/12/07/Photos/ZH/MW-FZ793_bitcoi_20171207120559_ZH.jpg?uuid=e58d7c9e-db70-11e7-b1f4-9c8e992d421e

Article at MarketWatch

https://www.marketwatch.com/story/people-googling-bitcoin-could-inadvertently-be-driving-its-massive-move-higher-2017-12-07?siteid=yhoof2&yptr=yahoo

That’s very interesting and not surprising. These past few days I was thinking about how various financial tools are really not available to the masses (like stock trading) without various gateways, while bitcoin is available to anyone and their grandmother.

I’m not sure what are the exact requirements needed to access any of the exhanges, though. Also, isn’t it interesting how much power, with surging prices, is wielded by exchanges?

Your questions are best asked in the Q4C response articles.

I personally have some doubts, provided you have enough power with zealots, death is the final frontier so I kept my hat on when David R. died recently.

Yes.

… was my first response to this comment, but I see it’s already been taken.

Global is another propery of bitcoin and if it turns out to be a bubble it’s going to involve a bunch of everyday people in a very direct way so a crash may bring the global middle class down a peg or two.

Taking an advice from probably every financial advisor on the planet, diversify and don’t put too much eggs in one basket. Godspeed.

One big advantage with cryptocurrencies is that they are “peer to peer” with no guberment regulation interjected into its exchange value.

OVERSTOCK.COM

One should look at their website (the about page), then the “Bitcoin page”. They take Bitcoin.

Also, read about their ethics.

My wife (ex-wife) will occasionally buy things from Overstock. She didn’t really know anything about cryptocurrencies like Bitcoin until last night when I told her over the phone and brought up Overstock.

Overstock had humble beginnings. Their first year (1999) ended with 1.8 million in sales.

When I had my book business, my 4th year (1999) I ended with about 3.5 million in sales. So, I have a comparative.

Overstock’s acceleration in sales was exponential following 1999.

“no guberment regulation interjected into its exchange value.”

But, my dear texan friend, is that really so? The “price” can be influenced from the ouside world and as long as fiat or, in other words, pretty printed paper is the blood of the system, government and its cronies, i.e. fascists, have yet to, like the fat lady, sing till the end can be had in sight.

Not only that, but we, the global peasantry, need to trust, i.e. believe blindily, the hidden inner workings and background proceedings of now a trillion dollar system, with the usual, as far as monetary sector goes, banking entourage “institutions.”

Finally, it is expected of us to forget that the “elite” stands to gain a lot from this paradigm shift. As long as they can have it their way, that is. But does one have to reiterate that we didn’t have any other way but theirs for a long, looong time now?

Perhaps in the future the “reference unit” for currencies will change from the dollar to a peer-to-peer model.

When the hype bleeds out of Bitcoin, perhaps it may used against other cryptocurrencies.

Transition can be a long process. Take sugar’s harmful effects or fluoride.

In the 1960’s, when we had leaded gasoline, I was making “peace signs” with lead from lead tire-balance weights.

News December 18, 2017

Overstock and an initial coin offering (ICO) for tokens for a new trading platform called tZero.

(The video within the article is well worth watching)

https://finance.yahoo.com/news/overstocks-250-million-ico-aims-disrupt-wall-street-trading-224100150.html

The CEO (Patrick Byrne) of Overstock poo-poos Wall Street and the government…

He has another big announcement coming.

EXCERPTS

The disruption Byrne speaks of would essentially turn aspects of Wall Street on its head. The coins offered in Monday’s ICO aren’t designed to be the next bitcoin, but rather to serve as tokens to use the tZero trading mechanism, which will host future ICOs, trading, and short-selling. It aims to operate as a “blockchain-ified” Wall Street exchange – potentially as an alternative to the NYSE.

Owners of these tokens will get a dividend-like revenue share from tZero as well as the ability to use the token in the exchange to facilitate trading and shorting. The advantage of this hybrid-model over traditional exchanges, Byrne says, is lower cost, transparency from a distributed ledger, and less shady business. The platform would initially trade the tZero token but plans to expand. Byrne sees tokens as the future of securities, with ICOs replacing IPOs.

Bloomberg – December 2017

Coinbase CEO on Crypto Surge, Bitcoin Futures, IRS

(10 minutes) https://www.youtube.com/watch?v=ZqF43uD3kKQ

The CEO of Coinbase was interviewed on Bloomberg.

They covered a lot of topics.

What stood out for me was that the IRS and Coinbase went to court. The IRS wanted the customer information on ALL of Coinbase’s users.

The Street – December 12, 2017

Why the Bitcoin and Cryptocurrency Economy Needs to Be Regulated — and How

https://www.thestreet.com/story/14418704/1/why-regulate-the-crypto-economy.html

EXCERPT

…Now is the time to talk about bridging the gap between the crypto and traditional economy in order to safely create better access to a level playing field. Smart regulation is not about removing regulation. On the contrary, it should embrace the sound, existing regulations of well-known securities and legacy protocols, while also embracing the opportunities for efficiency, good governance and accountability that blockchain technology offers….

Corbett Report Twitter – Dec 16, 2017

EU agrees clampdown on bitcoin platforms to tackle money laundering

https://twitter.com/corbettreport/status/941869875428859904

Dec 11, 2017

OilCoin: The World’s First Compliant Cryptocurrency

https://oilprice.com/Energy/Crude-Oil/OilCoin-Worlds-First-Compliant-Cryptocurrency.html

EXCERPTS

A team of banking and technology managers and former U.S. regulatory commissioners said on Monday that they are launching the world’s first regulatory compliant cryptocurrency backed by a physical asset—OilCoin, which will be based on oil reserves.

OilCoin’s public token sale, also known as the initial coin offering (ICO), is expected to begin in January 2018, said the team behind the project that includes Bart Chilton, former Commissioner at the U.S. Commodity Futures Trading Commission (CFTC) between 2007 and 2014.

The aim of the OilCoin is to tokenize barrels of oil, where each token will represent the value of one barrel, and provide users with a meaningful safe haven from cryptocurrency volatility, the team launching the digital currency said…

…OilCoin will comply with U.S. laws and regulations and will be suitable for global institutional and retail users, the team noted….

https://hashgraph.com/#sdk

Hashgraph The Future of Decentralized Technology

Hashgraph is data structure and consensus algorithm that is:

Fast: With a very high throughput and low consensus latency

Secure: Asynchronous Byzantine fault tolerant

Fair: Fairness of access, ordering, and timestamps

These properties enable new decentralized applications such as a stock market, improved collaborative applications, games, and auctions.

https://www.youtube.com/watch?v=ole2WuwNLL4

Very, very interesting.

john.o,

– Understanding Blockchain –

Like you pointed out, this really helped me to understand Blockchain Technology because it gave a comparative which addresses a Blockchain inherent problem.

Hashtag is close sourced and patented, correct?

My understanding is that the company has the fundamentals patented and that Hashgraph was developed by a handful of folks.

However, if you go to around the 54:30 of the video below (“Disruptive Innovation” comment), you hear about being able to download the techstack and being able to build on it.

Listening to the goals of the main developer (Leemon Baird) at the end of the video is really good news.

Yes, there is an SDK, but the code is proprietary. I.e. it will change in the way its proprietors intend it to change.

I’m not saying this doesn’t sound great, it does, but the code license is what it is.

Thanks mkey. You are much more savvy than I when it comes to this digital age.

This brings up “intellectual property rights” which I have always wrestled with from a philosophical/ethical perspective. I flip around on it.

When folks bust ass and risk all their funds towards creating a new concept type product, it seems only fair that they should benefit.

Intellectual property is what it is. Putting a copyright on an idea is very unnatural and thus instinctively bothersome.

The non voting does ring some bells, doens’t it lol

Well, abstaining from voting in such a situation is not an option. I don’t understand how does that play out mathematically, but it does sound like it has a lot of potential for abuse. All in all, a very tidy solution for a very messy problem.

Applying to the Byzantine generals situation, it would practically mean that all of the generals, and possibly soldiers, learned through gossip of the best option to attack, which would be right before the dawn, and just went for it, knowing everyone knows the same thing and would reach the exact same conclusion. This is either abstract math or bullshit.

This Hashgraph is one hell of a Disruptive Innovation and possibly may even change the internet to the way it should be.

(About 10 or 15 minutes)

https://youtu.be/SF362xxcfdk?t=51m50s

The interviews in the video above are well worth watching.

I love this QUOTE (around the 55:10 mark)

…For me the most exciting applications, or potential applications, for Hashgraph, are, in terms of internet of things, in terms of identity, and allowing us to being able to control our own identity instead of it being in the heads of corporations or other organizations….

It looks like a lot of hype to perhaps sucker in some investors and make the developers rich.

That’s not to say that there is not some genuine innovation in it, I honesty I have not looked enough into the technical details to Judge that, however the tech is closed source and patented.

It’s not uncommon for large companies to patent innovative ideas with no intention to develop them further just to stifle competition to their existing products.

Perhaps they are hoping the banks will buy them out to hinder future development of public block chain technology?

A simple rule of thumb is can you download the source code and be free to use it without asking anyones permission? If not then it is no good and is not an alternative to the blockchain.

There are going to be a lot of traps out there!

The “Voting” thing…

While I am a layman, my rendition is that it is agreement at a ‘truth’ quickly.

For example, the roulette or craps dealer calls out a number which came in. All eyes can see it, both winners and losers along with bystanders. They all vote a silent “yes”.

“TenX has figured out how to solve one of the biggest problems for people that are involved in cryptocurrency – actually spending the currency.” — Inc.

(36 second video)

https://www.youtube.com/watch?v=IjngOjwOrew

TenX website – https://www.tenx.tech/

TenX Twitter – https://twitter.com/tenxwallet?ref_src=twsrc%5Egoogle%7Ctwcamp%5Eserp%7Ctwgr%5Eauthor

Now, I am no expert on the “economy”…

But I am guessing that when people purchase cryptocurrencies with dollars, Euros, Yen, etc. that it takes those currencies out of circulation to a certain extent and those are “stored” virtually. In one respect, this can benefit the Central Banks with their fiat.

However, Mike Maloney has some very interesting things to say about “velocity” and currency circulation.

Mike Maloney traveled in the same circles as Robert T. Kiyosaki who was at the June 2017 G. Edward Griffin Red Pill Expo in Wyoming. James Corbett was also a “long distance” speaker for the Red Pill Expo.

https://redpillexpo.org/speakers/james-corbett/

Mike Maloney: Currency coming out of hiding & velocity & “Bad Moon Rising”

VIDEO 30 minutes – https://www.youtube.com/watch?v=P4_1pwsm5LY

I mention this Mike Maloney video, because it seems to me that in itself cryptocurrencies are not a real threat to Central Banks, UNLESS people can easily spend cryptocurrencies (such as what TenX is trying to make possible).

Creedence Clearwater Revival – Bad Moon Rising

https://www.youtube.com/watch?v=zUQiUFZ5RDw

I am not promoting TenX as a glorified technology. I am making a point of how it is a Disruptive Innovation, especially to the Central Banks.

Disruptive innovation is a term in the field of business administration which refers to an innovation that creates a new market and value network and eventually disrupts an existing market and value network, displacing established market leading firms, products, and alliances.

This fellow (who says he has had 35 years experience in tech) gives his positive take on Hashgraph.

https://www.youtube.com/watch?v=qBWKykG_O2E

He mentions Iota, a cryptocurrency which I heard about. And he talks about DAG.

The following “cryptonaut” fellow gives a nice layman overview of DAG and blockchain.

https://www.youtube.com/watch?v=I_jNH9BlEEo

People can bash Hashgraph all they want, but something along the lines of DAG or some other alternative will need to replace the slow, cumbersome, blockchain / bitcoin technology which has its problems.

For example: It cost me $12 to transfer 0.100 Bitcoin to my grandson and granddaughter a few weeks ago. Those kind of fees are not kind to currency. I am sure the fees are less at GDAX, but there are still fees. How can I simply buy bubblegum with cryptocurrency?

Hashgraph looks like a step in the right direction.

As things progress, I would wager that an open source rendition will come to fruition.

How can I simply buy bubblegum with cryptocurrency?

You need to buy a lot.

“I have come here to chew bubblegum and kick ass…and I’m all out of bubblegum.”

Classic line! They Live! – 1988

https://www.youtube.com/watch?v=Wp_K8prLfso

They make several good points. One being that hashgraph is currently designed to run on *private* networks and only there can they hope to achieve that high number of transactions and as such is not to be honestly compared to public ledgers, but with private ones, which are know to be capable of a high throughput in a controlled setting.

Thanks manbearpig!

Their newer more efficient pistols and rifles may not be our “liberators” but if we fight with bows and arrows we won’t even be even history, we will die unremembered as its phantoms.

Actually, it is considered that early gun powdered weapons were quite a lot less lethal than the bow and arrow. They did, however, make a lot more noise and as such were a lot more probable to scare and psychologically mutilate the opponent.

Just a thought:

21 million bitcoins (to 2020-2030? bitcoin bosses)

one bitcoin worth 1 million dollars (Webbot data sets (for 2020?))

21mX1M=21t

21 trillions whats missing from military activities according to a us professor and his students.

Coincidence or money laundering on a gigantic (for little economic household me!) scale?